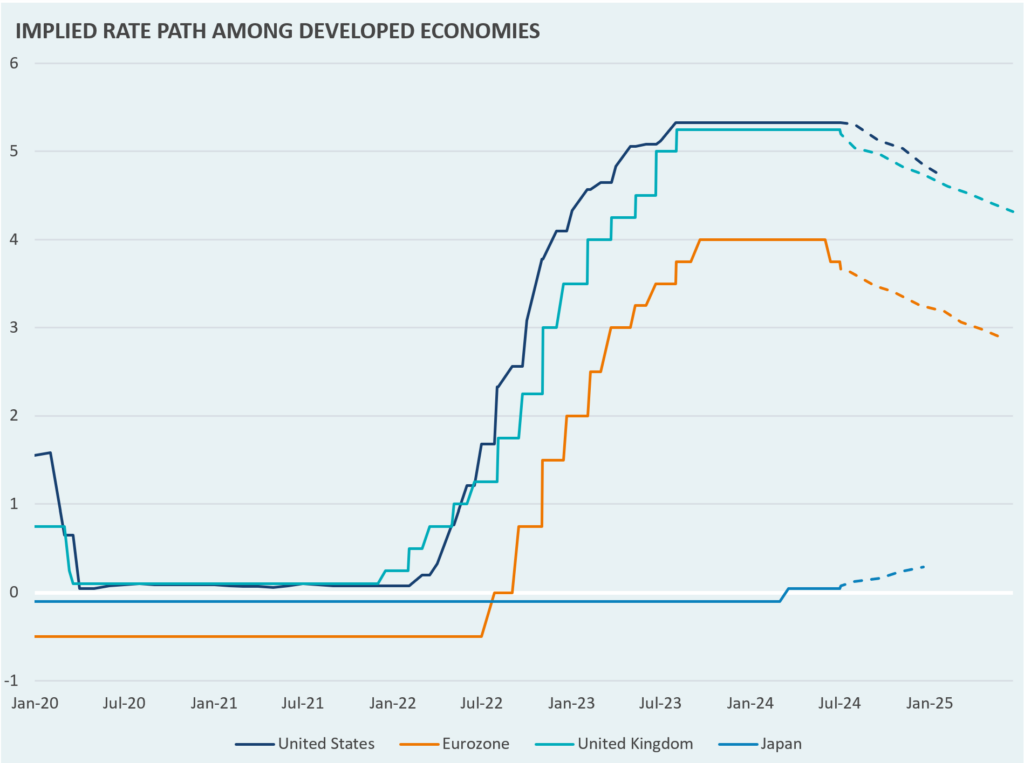

Following the recent inflationary cycle and subsequent interest rate hikes of the past two years, markets have spent much of 2024 eager for central banks across the world to begin cutting rates. Slowing inflation and weak growth (including a recession in the UK) prompted the Bank of England and European Central Bank to cut rates in June. The United States has seen more robust growth that only recently has shown signs of cooling, despite an aggressive hiking cycle. Relatively strong economic data and hesitancy from the Federal Reserve to cut rates has led to differing expectations for developed country rate paths.

This week’s chart demonstrates the central bank rate paths implied by futures market pricing. These implied paths suggest that while rates have diverged in the short term, markets are expecting largely similar policy paths from U.S. and European central banks.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.