For decades, China has shown exceptional economic growth, much of which was fueled by property construction and higher national debt loads. In many areas this has led to significant overbuilding and the accumulation of vacant properties for investment purposes rather than use. These property development practices and accompanying risks have come to the fore, following the default of the Evergrande Group and several other notable developers.

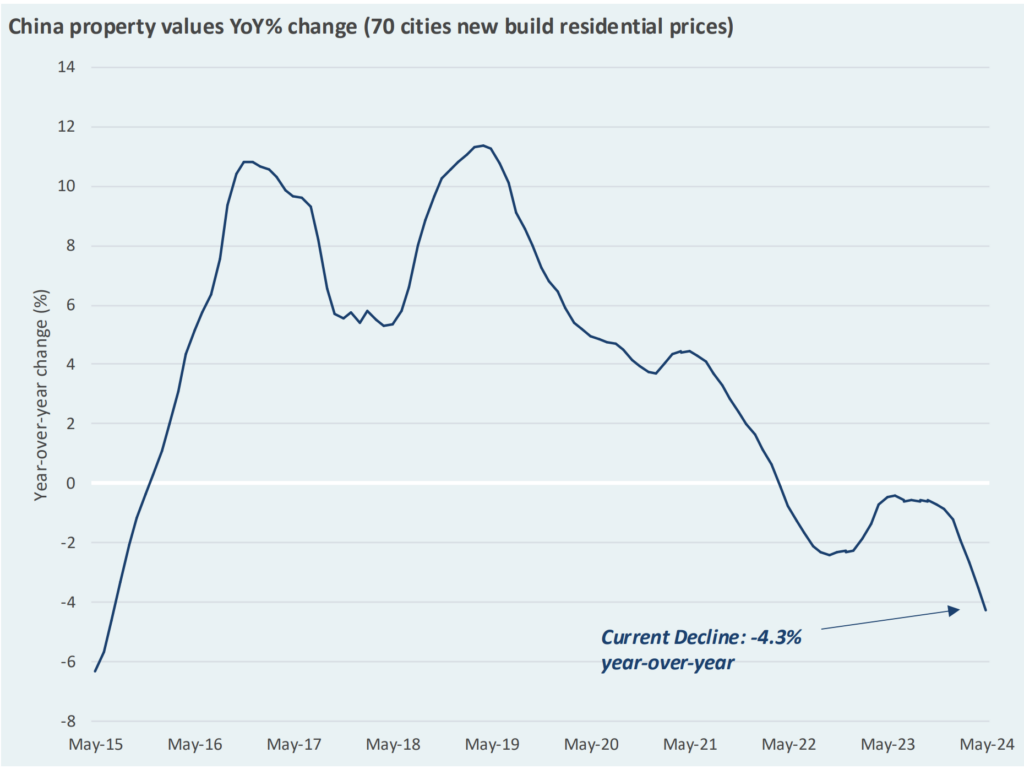

This week’s Market Note examines price declines of the Chinese real estate market. The significance of falling prices is two-fold. First, real estate development is estimated to have contributed around 20% of China’s total economic activity in recent years. A slowdown in development would have large negative impacts on growth and on employment. Second, the Chinese population is heavily invested in real estate which makes up a large portion of retirement portfolios—much more so than in the United States. If a property crash resulted in long-lasting losses in retirement portfolios, this would be incredibly damaging to the finances of the population and might even result in civil unrest.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.