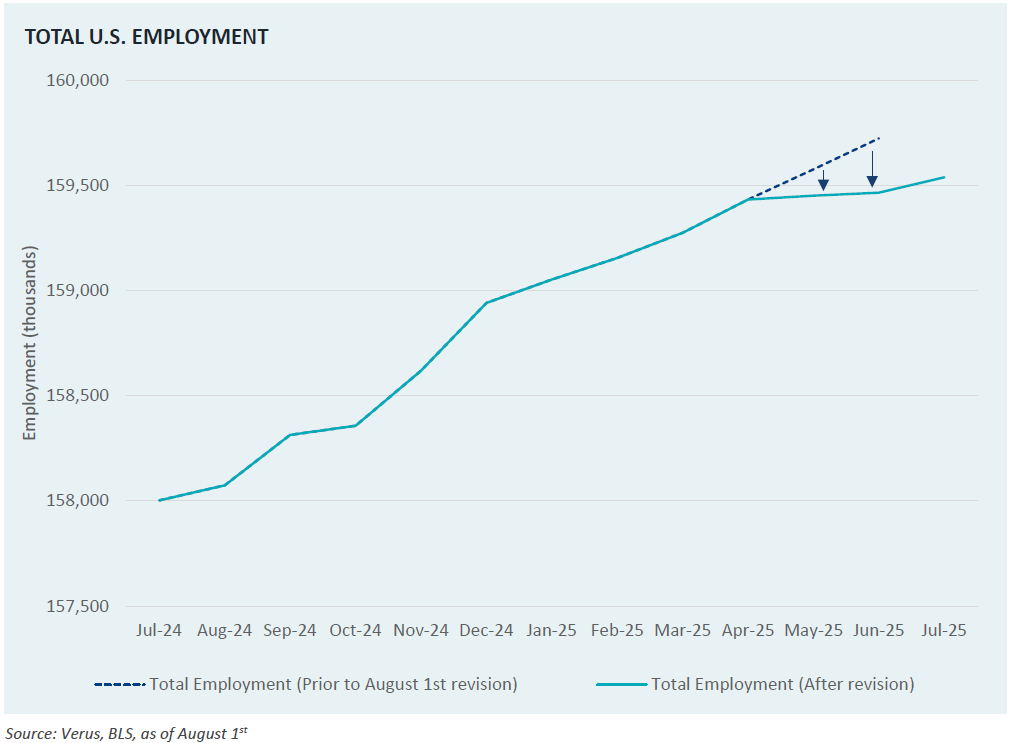

On August 1st, the Bureau of Labor Statistics released July U.S. employment numbers. Expecting another strong report, investors were surprised to see weaker July jobs creation of +73,000 (relative to +100,000 expected) and massive1 downward adjustments to prior May and June reports. Rather than the originally reported +144,000 jobs created in May, figures were revised to a meager +19,000 jobs. June job creations were revised down from +147,000 to +14,000. This historically large downward revision totaled -258,000 fewer jobs created than originally believed, which suggests job growth may be stalling.

In this week’s Market Note, we show the size of these revisions in terms of total U.S. employment. The probability of a Federal Reserve September rate cut jumped from 40% to 91% after this jobs report, bond yields moved materially lower, and equities sold off as investors priced in a less optimistic economic outlook.

- The word “massive” is not hyperbole in this case, as Moody’s reported that this is the largest jobs data revision since 1979. ↩︎

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.