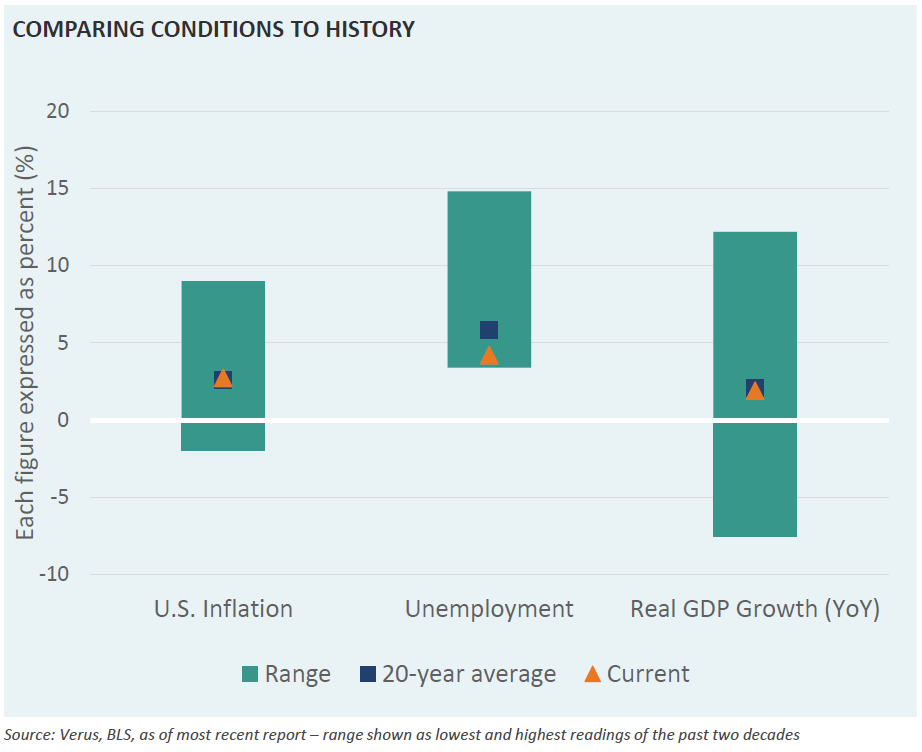

The price impact of tariffs has been fairly muted so far in comparison to what was initially feared, as inflation came in at 2.7% year-over-year in July. Investor expectations for inflation appear to be for a rise to a range of 3.0-3.5% peak inflation sometime in the next 12 months and then a fall to prior levels. Meanwhile, economic growth surprised to the upside in Q2, Q3 growth is forecast at 2.5% according the Atlanta Fed GDPNow indicator, and the economist average real growth forecast for calendar year 2025 is 1.6%, according to Bloomberg. The job market remains relatively strong at 4.2% unemployment. So, if the economy is growing at a moderate positive rate, the labor market is tight, and inflation is expected to rise slightly above the long-term average, where is the stagflation talk coming from?

In this week’s Market Note, we compare current levels of inflation, GDP growth, and unemployment to the 20-year average. “Stagflation” is generally thought to be a sustained period of economic stagnation and unusually high inflation (growth close to 0% and inflation substantially above average). Neither of those two things appears likely to occur based on available evidence.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.