Following the shift in U.S. trade policy that occurred in April, economists and many in the investor community warned of a sharp economic slowdown and likely a meaningful recession in 2025, fueled by job losses as employers downsized to cope with falling trade and an upward shock to inflation which would hurt demand. At Verus, we were skeptical of those calls for economic calamity throughout this period, as reflected by our moderately risk-on position in U.S. equities, and then our move to a total portfolio risk overweight in July. This call has proven profitable, as economic growth domestically and globally has consistently surprised to the upside, while inflation has barely budged.

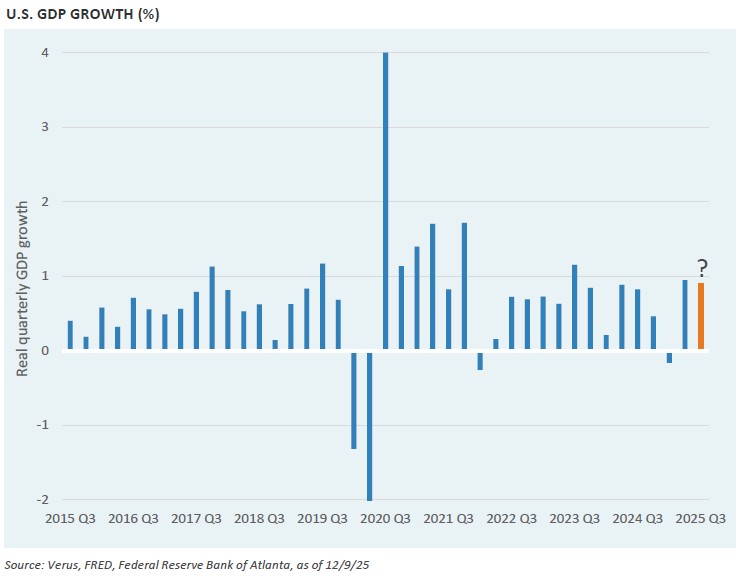

In this week’s Market Note, we illustrate that despite those broad calls for weak growth and spiking inflation, the U.S. economy has been chugging along at a nice pace. The economy grew at a historically strong 3.6% annualized rate in Q2 (although some of this was likely a bounceback from a very weak first quarter). Now, Q3 GDP is expected to show an impressively strong growth rate of 3.5% annualized, according to the Atlanta Federal Reserve GDPNow indicator. If this third quarter forecast turns out to be accurate, it would mean Q2 and Q3 were some of the strongest quarters of the past decade (excluding the COVID recovery).

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.