Download the full Topic of Interest (PDF)

Download the short summary (PDF)

Executive summary

The quickly rising interest rate environment has changed the landscape for commercial real estate so much that investors are questioning how the appraised values of their private real estate assets might change in the future. To illuminate this question, we begin with a discussion of historical cap rate movement, which has tended to track interest rates directionally but imperfectly. We examine how the private real estate market has responded to rising interest rates compared to the public real estate market, and how its response has contributed to disparities in performance. Finally, we show how the slow appraisal process of private assets has led to large gaps in valuations. Verus believes a gap still exists between where private market values should be and where they are actually marked. There will likely be continued pressure on property valuations, and we urge caution in deploying into existing pools of assets such as open-end funds. We also believe that there are real estate strategies that can benefit from investing in the current environment, such as allocating to opportunistic General Partners.

Historic relationship between interest rates and cap rates

Capitalization rate (“cap rate”) is a measure used to evaluate the return on investment of a real estate property. It is calculated by dividing the property’s net operating income (NOI) by its current market value. Interest rates, on the other hand, refer to the cost of borrowing money or the return on investment for fixed income securities. The two are generally considered to be correlated; when interest rates are low, borrowing costs decrease, making it more affordable for investors to finance real estate purchases. This increased demand for real estate investments can drive up property prices and result in lower cap rates (lower yields). Conversely, when interest rates rise, borrowing costs increase, which can reduce the demand for real estate investments. This decrease in demand can lead to lower property prices and higher cap rates. Higher interest rates may also make other investment options, such as fixed income, more attractive, thus further impacting demand for real estate and, therefore, cap rates.

It is important to note that the relationship between interest rates and cap rates is not always linear or immediate. Real estate markets are influenced by various factors, including supply and demand, the local economy, investor sentiment, and market cycles. While interest rates can significantly determine cap rates, they are not the sole determinant. Other fundamental factors specific to the property, such as location, condition, and income growth potential also play crucial roles in establishing the cap rate.

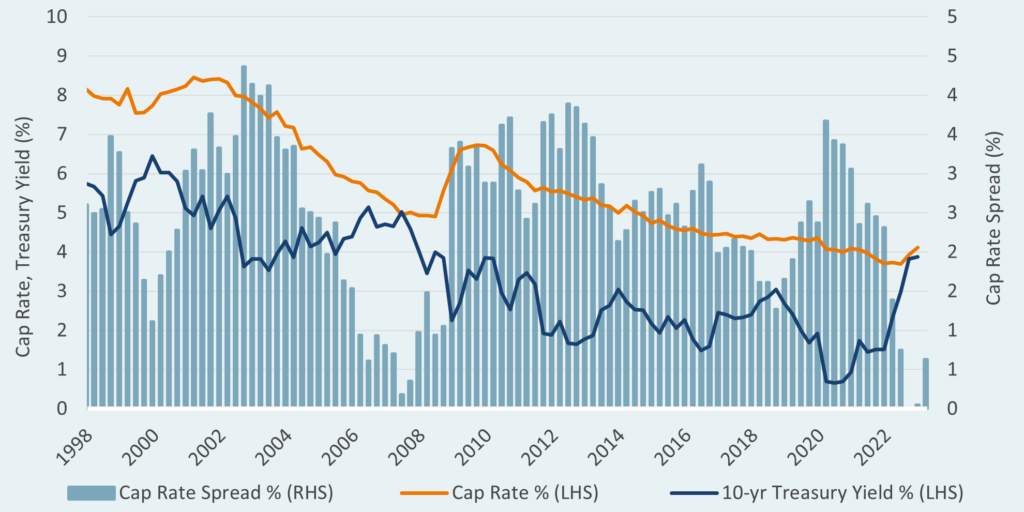

Over the past 25 years, investors have seen a downward trending interest rate regime. Average cap rates have generally tracked interest rates but not in lockstep. Over this period, the 10-year treasury rate fell from ~6% to below 1% in 2020. During the same time frame, cap rates fell from ~8% to just below 4%. Cap rate spreads to the 10-year treasury have averaged 2.4% over this period, but that spread has ranged at different times from 0% to 4%.

Historical spread between interest rates and cap rates

Recent impact on cap rates

Since the Federal Reserve began raising short-term interest rates, the 10-year treasury rate increased from 1.5% at the beginning of 2022 to 3.9% in March 2023. Private real estate cap rates, however, continued to decline until September 2022, bottoming at 3.8%. Since that time, average cap rates on core properties (according to NCREIF) have climbed only 0.4% to 4.2% at the end of the 1st quarter, 2023.

The public real estate market, comprised of publicly traded REIT securities, tends to be more sensitive to changes in interest rates and current market conditions. Implied cap rates are calculated based on the total market prices of REIT shares outstanding and the net operating income generated by their underlying real estate assets. Implied cap rates are a dynamic metric that can fluctuate daily based on changes in REIT share prices and underlying property income. Other factors, such as interest rates, market sentiment, equity market risks, and macroeconomic conditions will influence implied cap rates for REITs.

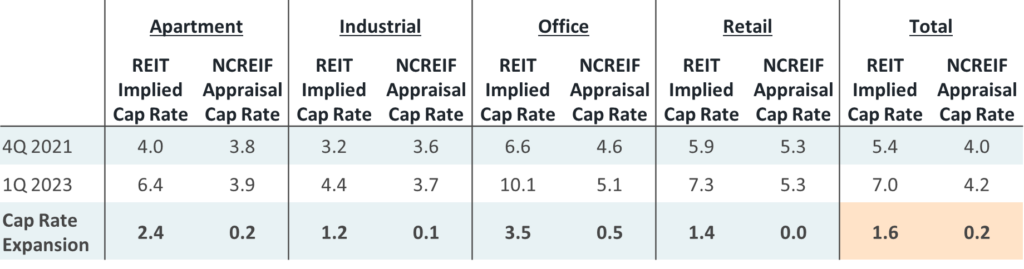

Implied cap rates have historically reflected a premium to private real estate cap rates. This is partly due to differences in composition of assets between the two markets. The REIT market includes a larger percentage of non-core property types, such as self-storage, senior housing, student housing, data centers, shopping malls, and other exposures. Over the last 10 years, the average premium has been 1.4%, which was where this premium sat at the end of 2021 (REIT implied cap rates of 5.4% and private cap rates at 4.0%). Since that time, implied cap rates for listed REITs have expanded +1.6% to 7.0% at the end of Q1 2023, while private market cap rates have only expanded +0.2%.

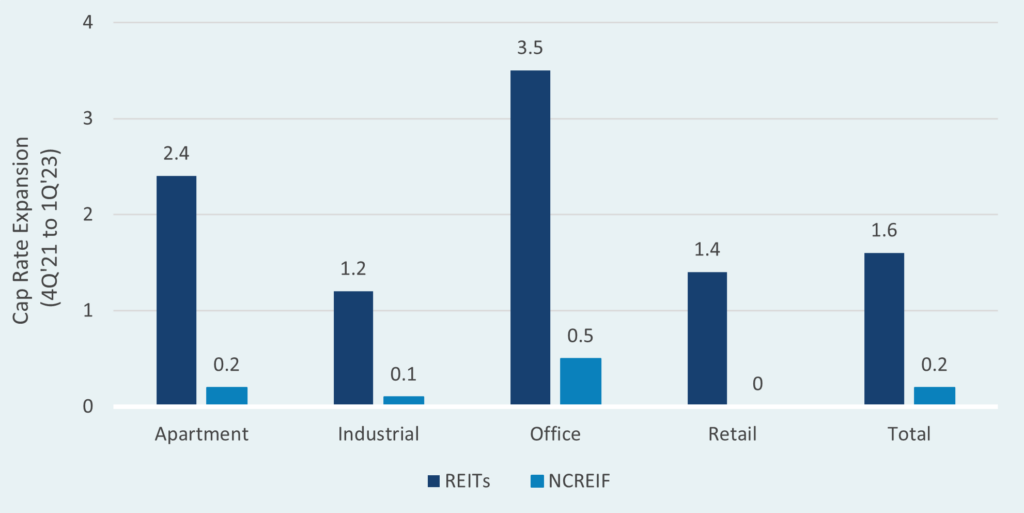

Public vs. private real estate cap rate expansion

Cap rate expansion has not been the same for every type of property. On one end of the spectrum, industrial properties, which have seen greater demand and favorable fundamentals due to the tailwinds of e-commerce, came into the rising rate environment with the lowest overall cap rates in the low-to-mid 3s and have experienced less cap rate expansion than other property types. Office, on the other hand, has seen significant uncertainty of demand due to the COVID-19 pandemic and emerging work-from-home trends. REIT implied cap rates for Office were already the highest at 6.6% at the beginning of 2022 and have expanded to 10.1%, while private cap rates have only modestly increased from 4.6% to 5.1%.

Cap rate expansion by property type

Recent performance – Public real estate (REITs) vs. Private Real Estate

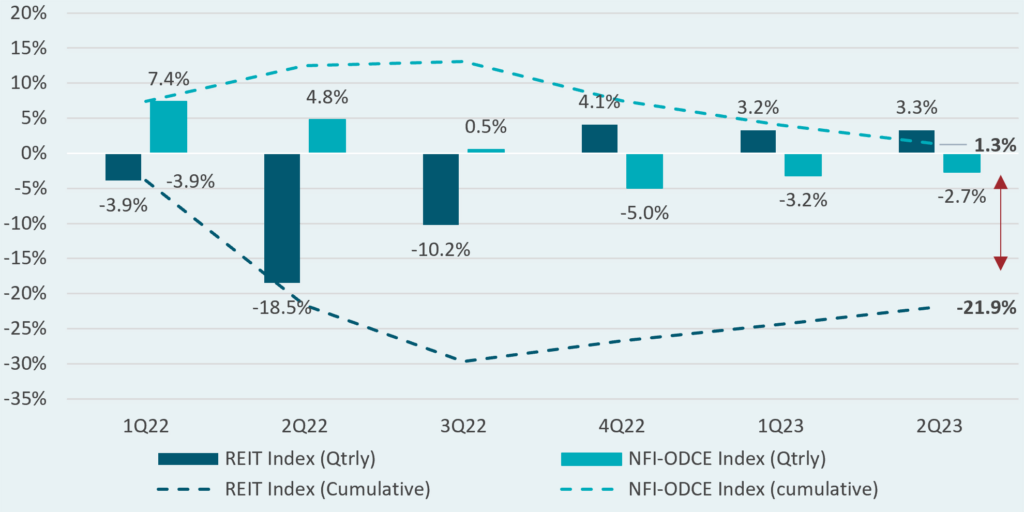

REITs were quick to respond to the rising interest rate environment. These investments started to see write downs in Q1 2022 when the Federal Reserve first began raising rates in March. In the first three quarters of 2022, REITs experienced a cumulative drawdown of -30% and have seen a slow recovery, recouping only +8% of the drawdown since that point.

On the other hand, private real estate continued to appreciate in the first three quarters of 2022, experiencing a cumulative +13% mark up during that time. Not until Q4 2022 did private markets finally take their first write-down of -5% and have had subsequent write-downs of ~-3% in each of the first two quarters of 2023. Since the beginning of 2022, private real estate valuations are still up +1% in aggregate with a -12% write-down from their peak valuation.

Public vs. private real estate performance dispersion

Lag effect in private real estate appraisal process

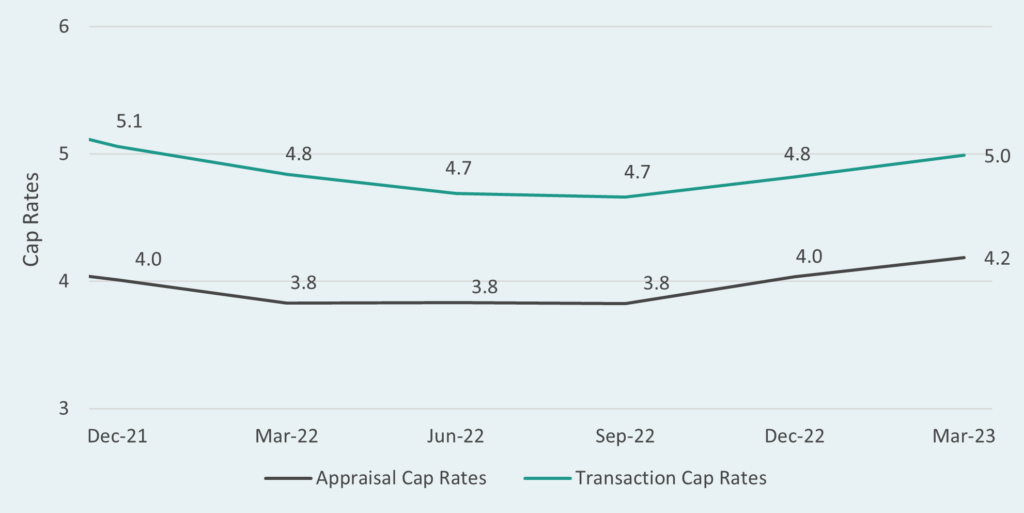

The appraisal process used to value private real estate takes longer to recognize macro changes than the market-sensitive listed REIT market. This is a key reason for explaining the differences in return profile in the diagram above. First, appraisers tend to anchor estimated property values on the most recent appraised values, which means valuations can be slow to reflect true market value. Second, the appraisal process is more reliant upon comparable trades or “comps,” which have slowed dramatically over the last year. For example, the market value of private real estate transactions that closed in Q1 2023 (as tracked by NCREIF) was less than half of the transaction volume in the same period one-year prior. In periods of uncertainty such as ours, appraisers have fewer trades or comps to compare existing property values to and must rely on older comps that may be higher in value than what is reflected in the current building market. It is not uncommon during periods of stress, market illiquidity, and economic uncertainty, for transaction levels to slow as prices widen between what buyers are willing to pay and what sellers still expect to receive. The widening bid-ask spread slows transactions from closing and adds to the uncertainty regarding valuations. For transactions that have closed, we have seen higher cap rates associated with those properties than existing assets going through traditional appraisal processes, as seen below. Transaction cap rates have been 0.8% to 1.1% higher than appraised values, in aggregate. Cap rates have historically been higher for properties with issues that require renovations or some sort of stabilization, but the current spread is larger than normal. We believe there will continue to be upward pressure on cap rates, even with limited transaction volumes.

Appraisal cap rates vs. transaction cap rates

Dry powder and transaction cap rates

The other dynamic in private real estate revolves around transaction cap rates happening below the cost of debt, most noticeably in the multi-family and industrial sectors. Transaction cap rates in industrial are hovering in the low 4s, while multi-family are closer to the low 5s. The cost of debt varies by property but ranges 6-8%, meaning leverage is negatively contributing to returns on deals being financed today. The pressure to put money to work is contributing to what we consider a bizarre deal environment where equity is priced to return less than the debt sitting in front of it. Some might argue that an inverted U.S. yield curve suggests that interest rates will fall in the future, and, therefore, low cap rates may soon make more sense when U.S. interest rates fall. We can follow the logic of that argument, but even if this were to occur, it would only bring cap rates around ~1% above U.S. Treasury rates, which is extremely low. While we have no certainty about where interest rates are headed in the next two years, we are concerned that real estate valuations reflect an unrealistically rosy scenario of continued growth in income and interest rates moving back down to near zero in the not-too-distant future. Overall, until we see transaction values move higher, we expect private fund appraisals to continue a slow grind downwards.

Conclusions

Verus believes that a gap still exists between where private market values should be versus where they are currently marked. The slow appraisal process and unusual transaction market means that many existing private market properties have not marked cap rates up enough, and, therefore, have not marked values down enough. While it may be unlikely that private market cap rates can reach levels implied by the REIT market – and history has shown that the REIT market has tended to overshoot at the extremes – the spreads are too wide to ignore. The correct valuations are likely to be somewhere in the middle. This means that open-end funds and existing pools of properties will likely keep facing more valuation pressures in the upcoming quarters with appraised values further falling.

Verus recommends taking a cautious approach to deploying capital in the current environment. We believe investors should avoid deploying capital into pools of assets that are characterized by uncertain valuations. However, we also believe that there are strategies that can benefit from investing in the current environment. We favor opportunistic General Partners that have experience in investing in stress and distress as many property owners are facing challenges in refinancing and need creative solutions such as equity gap financing, rescue capital, and preferred equity solutions. General Partners experienced with investing in the debt side of the capital stack should find attractive opportunities as traditional banks and insurance company lenders have become less active as they are currently retrenching and shoring up balance sheets. Until we see existing property valuations stabilize, we prefer closed-end funds that will be deploying fresh capital over the next several years, likely buying in at more attractive entry prices post dislocation. For more information regarding our views on these topics, please reach out to your Verus consultant.