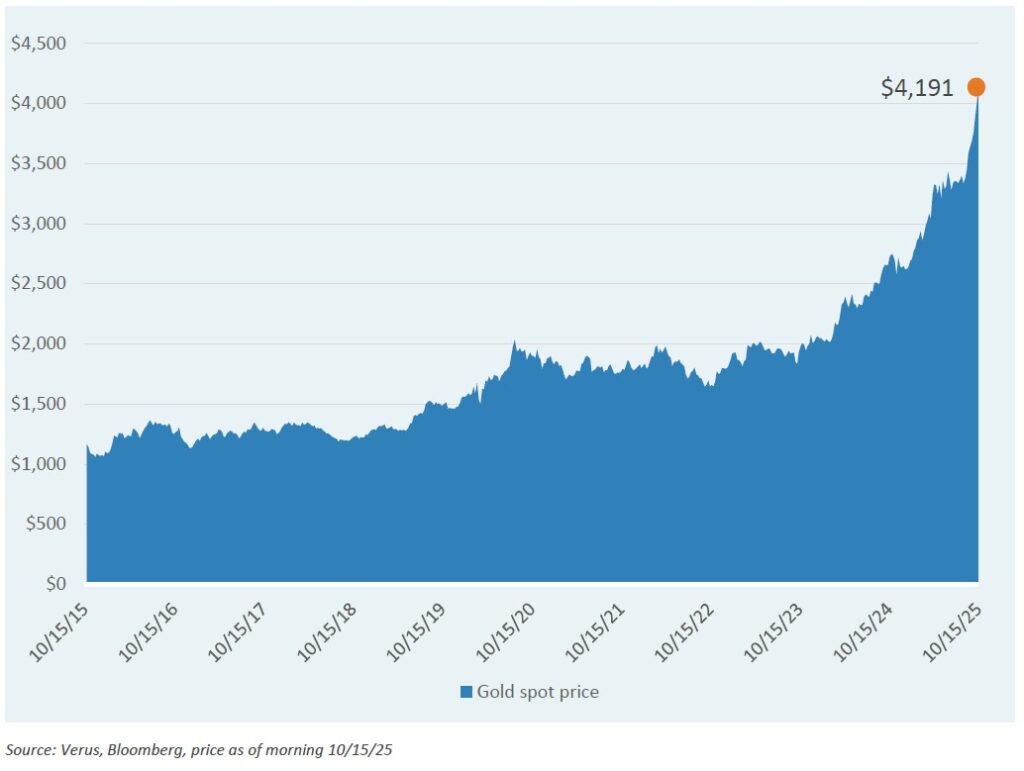

In 2025, the price of gold has continued to skyrocket, up a remarkable +57% year-to-date. A wide variety of factors can influence the price of gold, including government purchase trends, interest rate fluctuations which impact the opportunity cost of holding the metal (gold provides no yield, which means it is more costly to hold during higher interest rate environments), investor demand for safe-haven assets, and fears of inflation and/or currency debasement. This makes it especially difficult to pin down why gold has moved so dramatically in recent years.

In this week’s Market Note, we illustrate the rise of gold price given its renewed popularity. Much of the recent commentary around gold’s rally has pinned this trend on rising risks of inflation and currency debasement. We are skeptical of this story, at least in terms of describing year-to-date performance, given that inflation expectations have not moved higher during that time (neither TIPS Breakeven Rates nor 5-year 5-year forward inflation), and the U.S. dollar is slightly higher since the passing of the “One Big Beautiful Bill Act” in July.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.