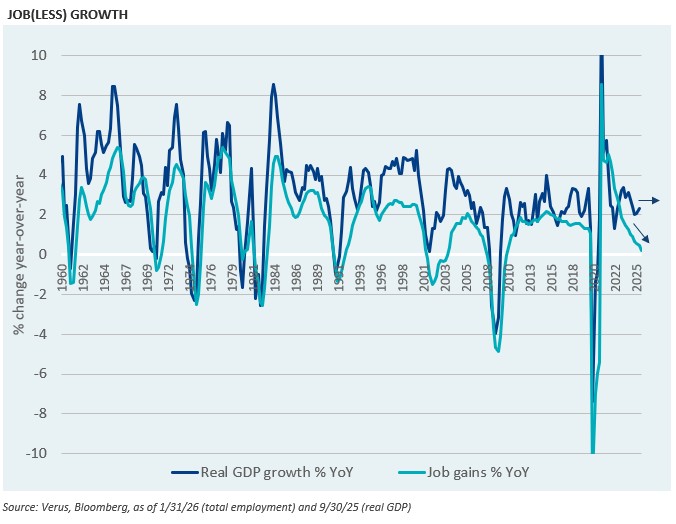

U.S. economic growth surprised to the upside during 2025, and it appears that the calendar year real growth rate will likely show in the mid-2% range. Meanwhile, job creation slowed and was barely positive over the past year, with nonfarm payrolls increasing a paltry +0.2%, as of January. Economic expansions without meaningful job growth have been somewhat rare, historically speaking.

In this week’s Market Note, we illustrate a widening gap between the rate of job growth and the growth rate of the overall economy. At first glance, the trend appears similar to the mid-1990s and subsequent years―a time when widespread adoption of a new technology (the personal computer) led to substantial productivity growth and therefore economic growth that far outpaced job growth. Business capital deepening during that time contributed to annual productivity gains of greater than 5% in certain sectors, as many routine office tasks were automated and decision-making times were greatly reduced. If recent productivity gains continue to accelerate, conditions today may prove similar to the technological revolution of the 1990s.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.