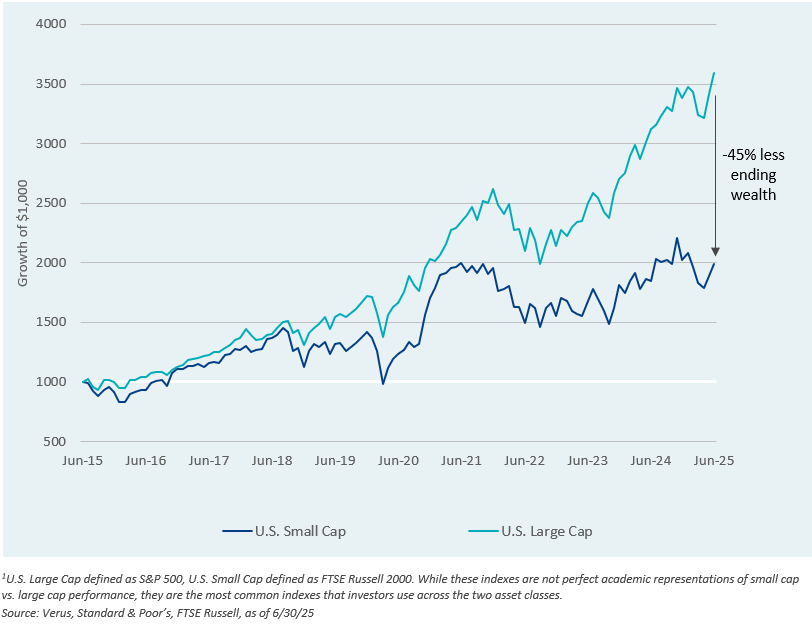

Domestic small cap stocks have consistently underperformed large cap stocks for an extended period of time. Over the past decade, an investment in small caps would have ended in -45% less wealth than an investment in large caps1. During that time, small caps underperformed in 2015, 2017, 2018, 2019, 2021, 2022, 2023, 2024, and 2025 year-to-date as of June 30th. Given weak earnings growth, aging businesses, and a rising portion of index companies that are unprofitable, many investors are questioning the case for a dedicated U.S. small cap allocation. However, we believe skilled active management has and may continue to assist investors in achieving alpha and mitigating some of these benchmark issues.

In this week’s Market Note, we outline the cumulative performance of U.S. small caps relative to U.S. large caps over the past decade.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.