The U.S. equity market has continued to become more concentrated in recent years, as mega-cap companies grow in terms of global presence and profits. Seven dominant companies, often referred to as the “Magnificent 7”, include Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla. Many of these businesses are on the cutting edge of newer technologies such as artificial intelligence, advanced robotics, and self-driving transportation. Their incredible performance has led to concerns about the level of market concentration.

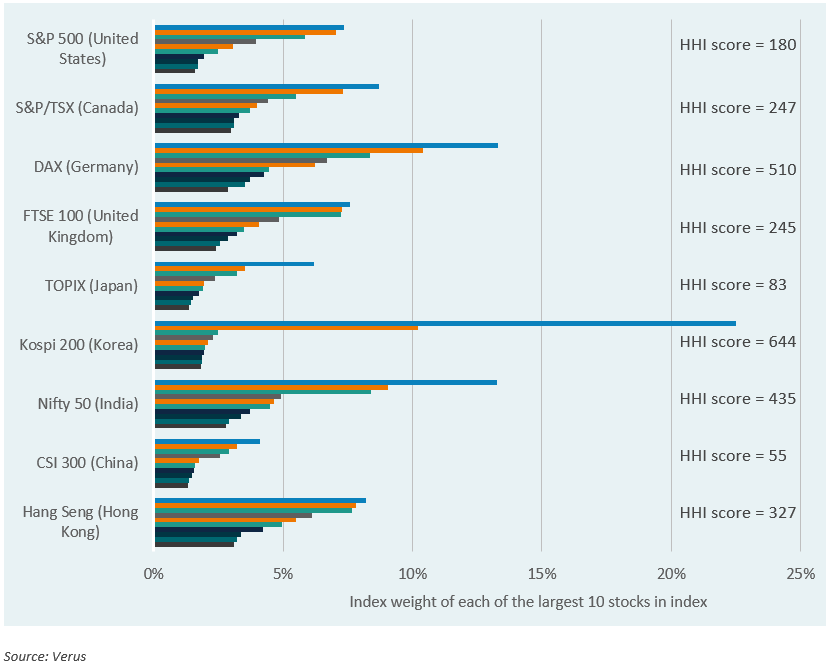

In this week’s Market Note, we compare the market weight of the largest 10 stocks in the S&P 500 to the largest 10 stocks of other regional markets. It may come as a surprise that the U.S. market is not particularly concentrated, relatively speaking—many other regional markets are substantially more concentrated and have remained so for a long time. The Herfindahl-Hirschman Index (HHI) is a common technical method for measuring market concentration. We have calculated the HHI score of each regional market using the largest 10 stocks, and we show respective concentration scoring in our chart. Market concentration is not necessarily itself a negative market quality, if that concentration results from large successful globally competitive businesses with pricing power, but may become an issue when mega-cap stocks are overvalued.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.