Download the full Topic of Interest (PDF)

Download the short summary (PDF)

Executive summary

Taft-Hartley pension funds in the United States often make allocations to private real estate with the dual objectives of generating robust returns and supporting union workers by investing in “labor-friendly” real estate strategies. There is occasionally a misconception that investing in labor-friendly real estate strategies involves sacrificing performance. In this Topic of Interest white paper, we examine core real estate manager performance over time using the North American Building Trades Report Card¹ to identify whether a performance difference does in fact exist. We conclude, based on the data, that labor-friendly private real estate performance has been competitive with the broader private real estate universe and that significant return was not sacrificed when investing in labor-friendly strategies during the period examined.

North American Building Trades Report Card

The North American Building Trades Union (NABTU) Real Estate Manager Report Card strives to assign a grade to real estate strategies based on the language contained in the manager’s Responsible Contractor Policy (RCP) and the implementation of the policy. A variety of characteristics are evaluated, including but not limited to: what aspects of the project are covered by the RCP, does the real estate manager notify local trades of the upcoming project, whether a past record of labor disputes exists, and whether employee work hours are reported.

We have divided all core real estate strategies that have completed this survey into two categories: the half of the product universe with the highest grades, and the half of the product universe with the lowest grades. The average scores of each of the two categories are used for this analysis. While the grades do not necessarily conclude that a manager/product is good or bad, it provides a means of evaluating the robustness of their engagement with various labor organizations and their willingness to enforce the provisions within their policies regarding organized labor.

Comparing characteristics: highest grades vs. lowest grades

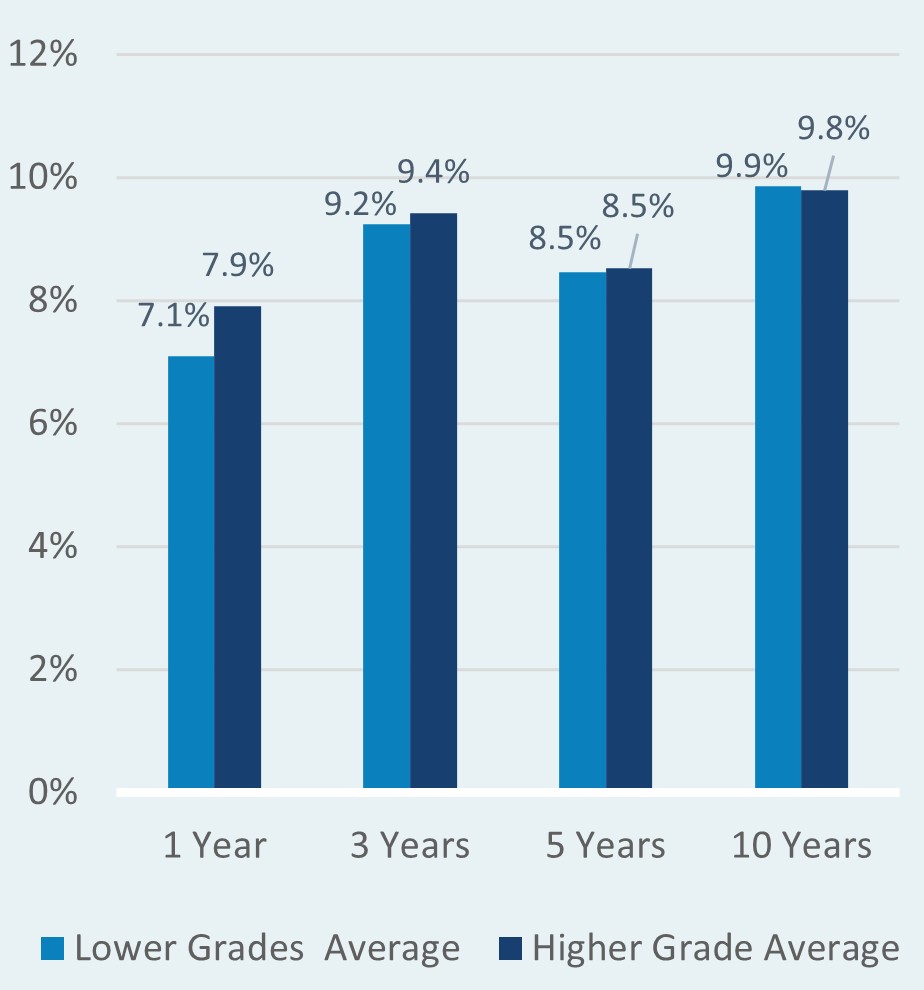

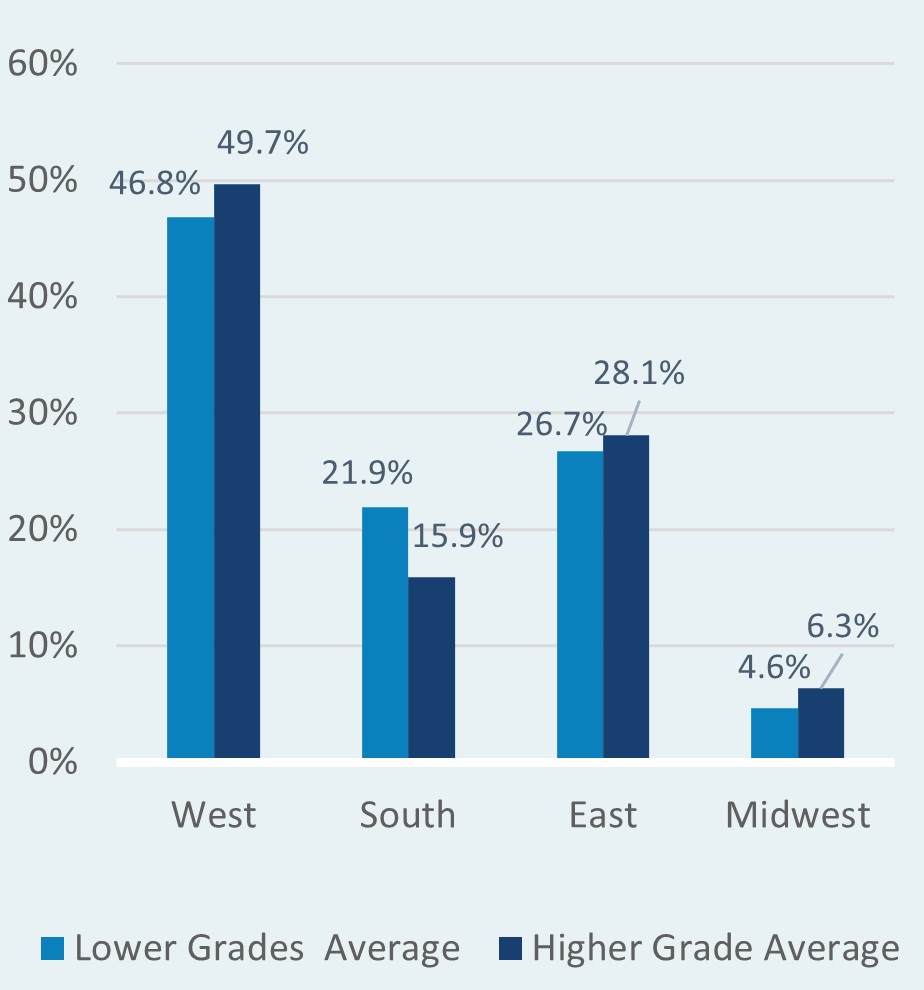

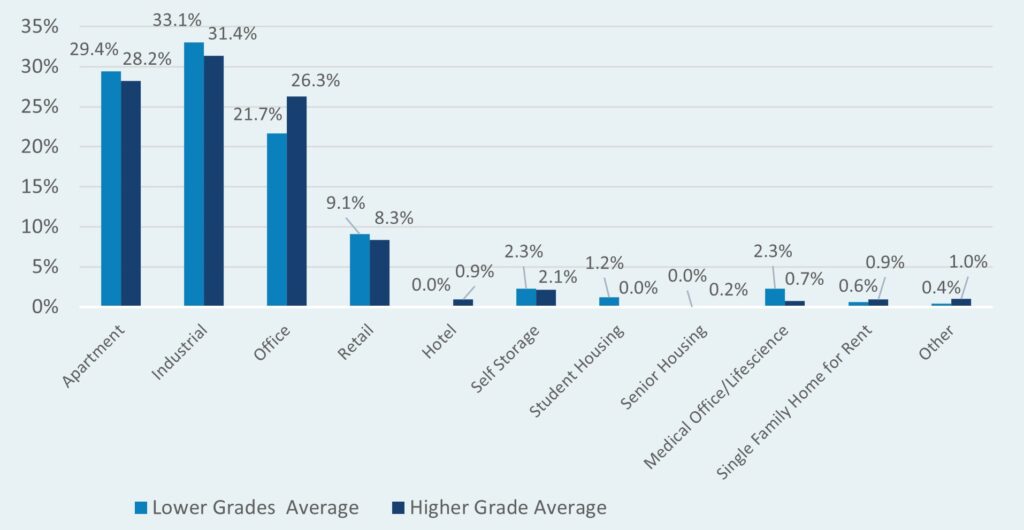

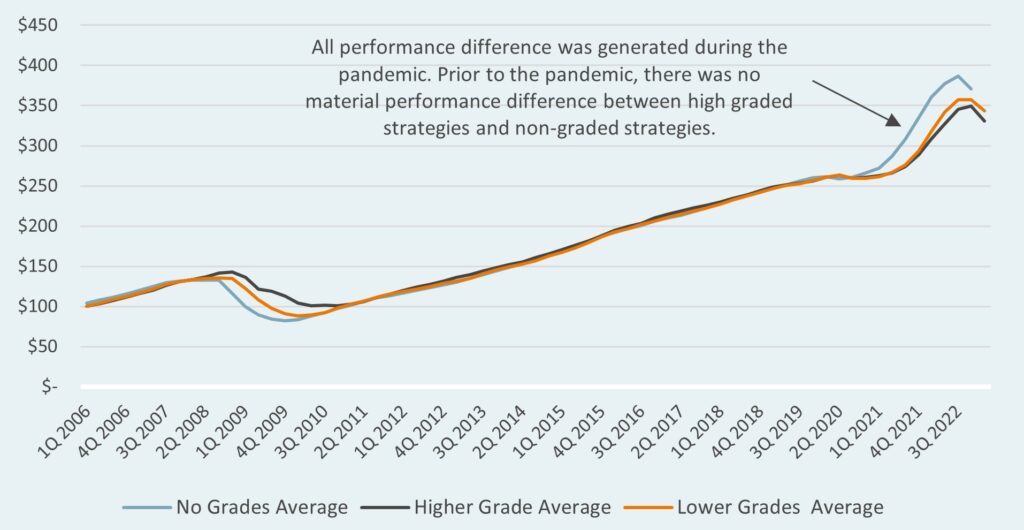

Below we illustrate the results of the analysis. First, we find no material difference in performance between the core real estate strategies with the highest grades and those with the lowest grades. The performance of each set of strategies is displayed below, along with sector and geographic exposure. The similarities of exposures across groups suggests to us that exposure type did not play a major role in performance outcomes. In fact, higher graded real estate strategies produced equivalent performance despite holding greater investments in office real estate (office has been one of the worst-performing real estate sectors as of late). Higher office allocations of these strategies make sense, given the union concentration in major cities with large office buildings and the many union jobs created by ongoing tenant improvement processes.

Performance by report card grade

Exposure by region

Exposure by property type

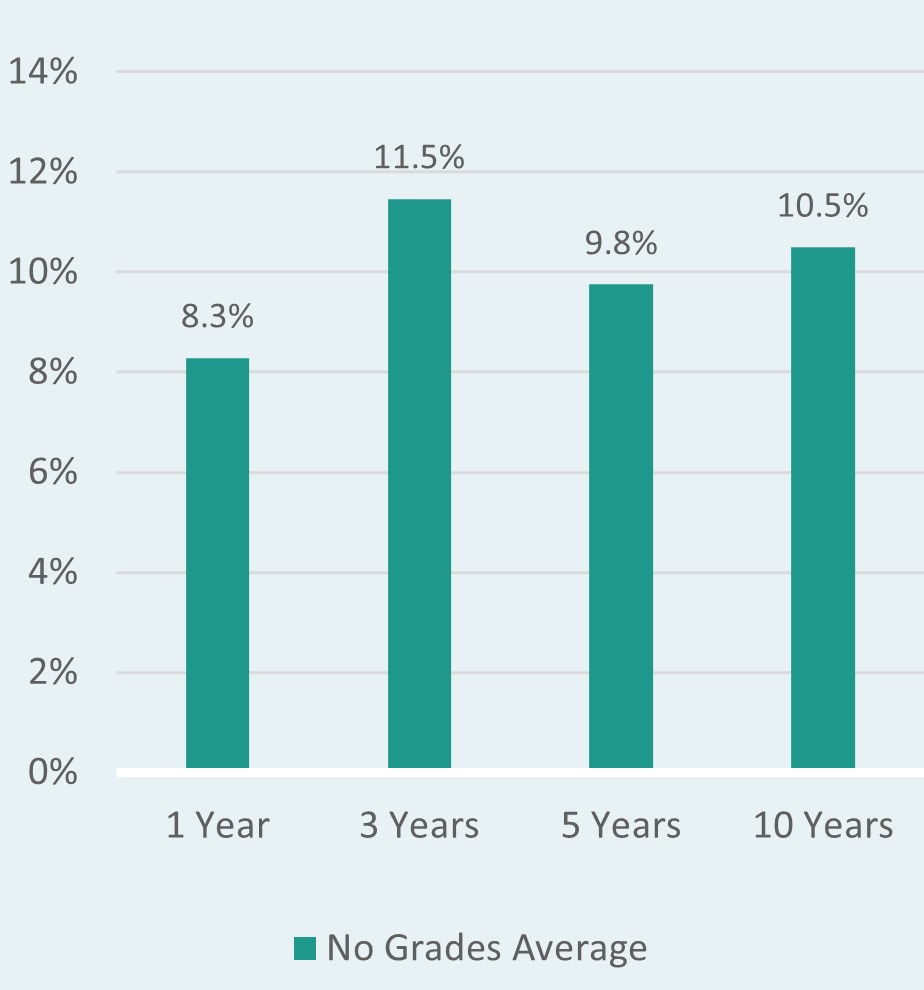

The NABTU report card is not all-inclusive: there are several core real estate funds not rated on the report card. In order to complete a thorough analysis, we also looked at managers that were not included in the report card. These managers may or may not be labor-friendly. We used our internal Verus Core Real Estate Survey results for this data. The survey is conducted once a year and compiles all relevant information needed to make a useful comparison.

Returns of non-graded strategies

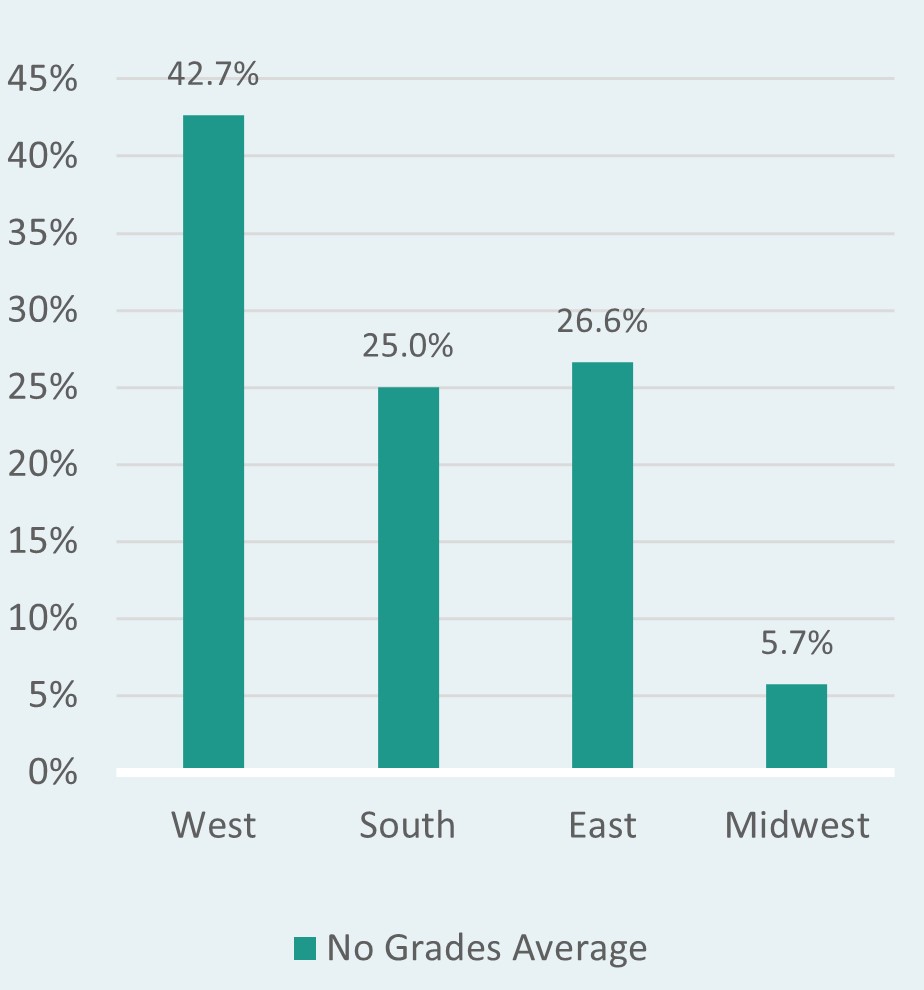

Exposure by region

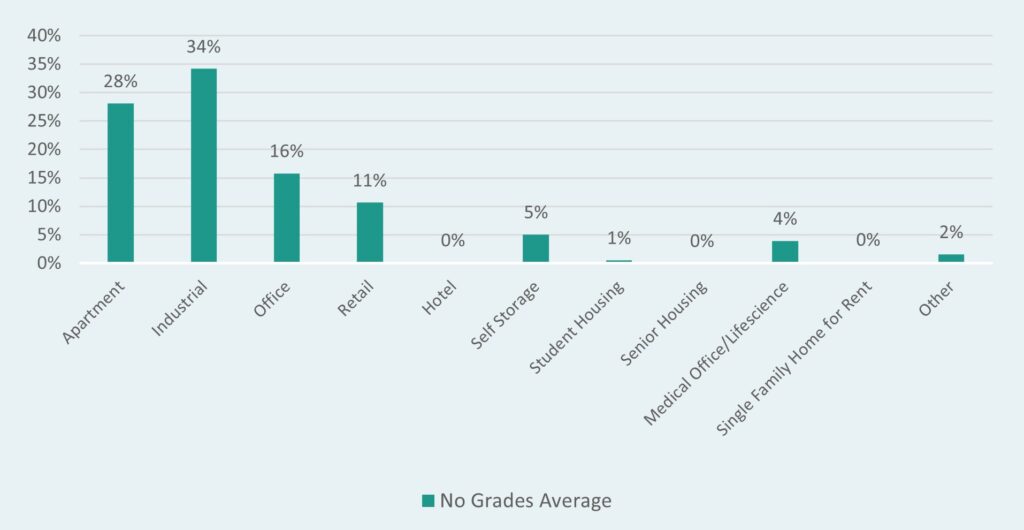

Exposure by property type

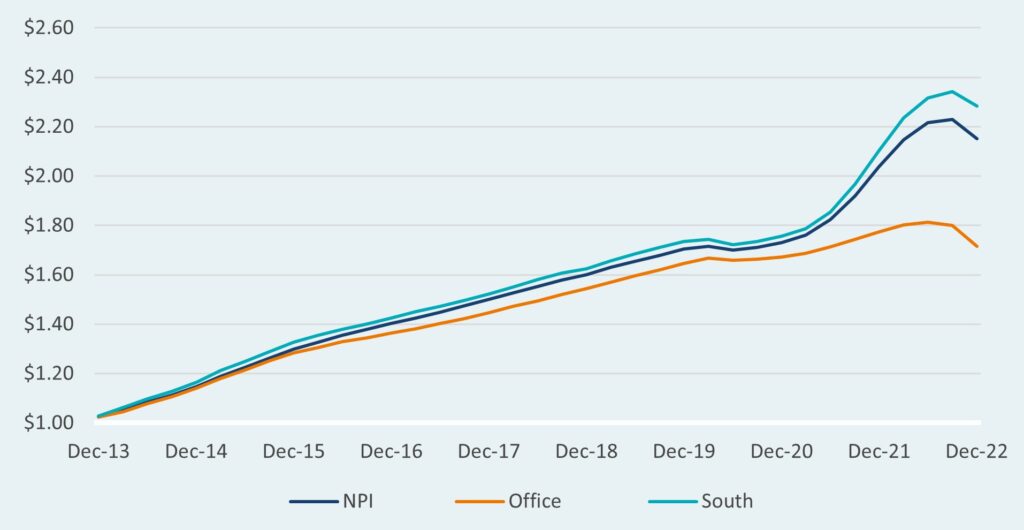

We do find a material performance difference in non-graded strategies. The non-graded strategies have outperformed over all trailing time periods. Much of this can be attributed to sector and geographic allocations and recent Covid-driven performance dispersion in those sector/regions. The non-rated strategies had dramatically less exposure to office real estate, which as mentioned has been one of the worst performing sectors in recent years. As shown in the chart below, the office sector underperformed the broader NCREIF Property Index significantly, by 8.9% in 2022 and 11.6% in 2021. The Covid-19 pandemic created headwinds to office properties as more employees were forced into working from home and now are continuing to work from home at a much greater rate than prior to Covid, decreasing demand for traditional office. Non-graded strategies have lower exposure to the office sector (16.0% average exposure, relative to 21.7% in lower-graded strategies and 26.3% in higher-graded strategies) as well as larger exposures to alternative property types (especially Self-Storage and Medical Office) which have been strong performing segments.

Additionally, these non-graded strategies held far greater investments in Southern U.S. real estate―a region experiencing tremendous population growth and real estate valuation increases. Areas in the southern U.S. tend to have less unionization, which could also account for the increased allocation by non-graded strategies (non-graded strategies held 25% average exposure, relative to 21.9% in lower-graded strategies and 15.9% in higher-graded strategies.) The South region has outperformed the broader NCREIF Property Index in recent years (3.0% outperformance in 2022 and 2.1% in 2021). The tailwind created from greater exposure in the South has been less impactful than the office sector allocations, but when combined, helps in explaining the recent performance differences.

Excess annual returns vs. NPI

Growth of dollar vs. NPI

By analyzing trailing performance only, Trustees might be tempted to allocate to a strategy that did not respond to the survey, rather than to a high-graded strategy. However, upon further analysis it appears that the majority, if not all of the outperformance has come during the most recent 2-year period, stemming primarily from the impacts of the pandemic. We believe this performance benefit is temporary and that it can largely be attributed to idiosyncratic issues, rather than persistent outperformance. In almost all prior periods, there has been no material performance differences between graded and non-graded strategies. We see only two time periods in which performance diverged, one of which was a benefit to non-graded strategies, one of which was detracting from non-graded strategies. The growth of the $100 chart below illustrates this point.

Recent performance difference due to covid-19

Where managers invest, and the property types in which they invest, are of course important as these decisions are the main drivers of return. However, the data suggests that a bias towards real estate managers that are seen as friendlier to labor does not hurt performance over the long run. One could argue that the current higher office exposure may be a near-term headwind for higher-rated strategies as the office sector faces continued challenges in the current environment. We would point out however, that these allocation differences are point-in-time snapshots with dynamic and changing allocations. Conversations with highly rated managers indicate a desire to reduce office exposures and also add exposures to markets with higher growth over time, such as the South. Even in markets where there is a lower prevalence of union labor, many highly rated strategies are not precluded from investing in those markets but must use best efforts to make open project bids, report hours, etc. which will be a benefit to organized labor in those markets.

Conclusion

Taft-Hartley pension funds in the United States often make allocations to private real estate with the dual objectives of generating robust returns and supporting union workers by investing in “labor-friendly” real estate strategies. While there may occasionally be a misconception that investing in these real estate strategies involves a sacrifice of performance, the data suggests that the performance of private real estate managers with robust Responsible Contractor Policies and strong enforcement measures is competitive with the broader private real estate universe. This is important because as fiduciaries, Boards of Trustees must act in the best interest of the plan participants. The higher-graded strategies that more actively engage with labor may offer a dual benefit of competitive returns and contribution hours. For additional perspectives on this topic, please reach out to your Verus consultant.

1 Real Estate Manager Report card. NABTU. (2022, July 25). Retrieved March 14, 2023, from https://nabtu.org/nabtu-real-estate-manager-report-card/