Download the Topic of Interest (PDF)

In this research piece we provide an introduction to mortgage income and the strategic role that this exposure might play in portfolios. We start with a top-level overview of where the asset class fits within the spectrum of private real estate and debt. Then, we walk through the history of the asset class, the range and quality of real estate loans in which an institution might invest, and where mortgage income sits within that range. Next, we discuss how an investor might think about this asset class—specifically, is it risk-diversifying or risk-seeking? Next, we touch on the privately traded nature of mortgage income, and how, as with most private assets, appraisal-based pricing can partly mask risk. Lastly, we remind the reader that this is an actively managed space, and talk through how Verus navigates this asset class.

Introduction to mortgage income

What is mortgage income and how does it fit into a portfolio? A useful high-level starting point is to visualize the range of investment types within the real estate space, in terms of equity and debt investments, and in terms of liquidity or illiquidity (i.e. publicly traded or privately traded). This range is illustrated below.

Indexing the commercial real estate market

Source: John B. Levy & Company

An argument can be made that the asset class is a fixed income allocation, as it is an investment in debt, but a separate argument can also be made that it is a real assets/real estate allocation since it is an investment in real estate (though a different layer of the capital structure)1. Reasonable investors may have differing views on this. Mortgage income is backed by properties as collateral and generates returns through the interest rate on the debt and fees paid by the borrower2. Debt instruments typically take the form of a mortgage or deed of trust. These loans are made to owners or buyers of existing properties, as well as developers. Properties may include retail, shopping, multi-family, industrial, and hotel. Mortgage income tends to be privately traded and illiquid.

The U.S. commercial mortgage market has experienced strong and steady growth for many decades. Prior to the 2008-2009 Global Financial Crisis, insurance companies and banks held most of the domestic commercial mortgage market, providing less opportunity for sizable institutional investment. Following the crisis, regulations were tightened materially which led those insurers and banks to divest from this marketplace. Those events created a need for capital and contributed to the rise of the asset class as an institutional retirement plan holding. Commercial real estate debt overall is now a $5 trillion marketplace across commercial and multifamily mortgages3, with banks providing roughly half of total financing.

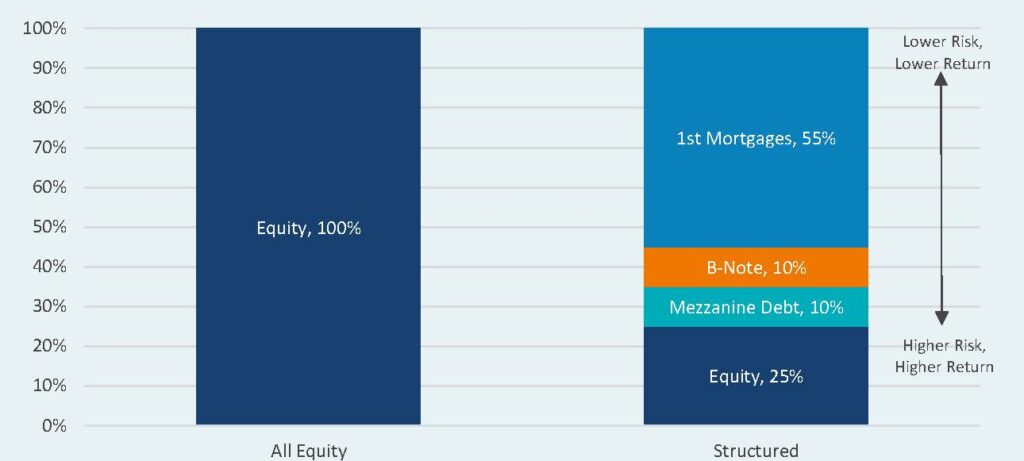

To better understand mortgage income, it may be helpful to take a brief look at the broader real estate debt space. Real estate debt includes 1st mortgages, mezzanine debt, participating mortgages, real estate equity, and commercial mortgage-backed securities (CMBS). Mortgage income managers invest primarily in 1st mortgages—the highest quality loans within the overall real estate debt space. Mortgage Income managers typically invest in private illiquid assets, but may also hold a smaller allocation to liquid assets. The type of property, liquidity, and where the loan sits in the capital stack can result in a wide range of risk and return profiles across the real estate debt spectrum. The stage of project is also a primary determinant of risk—construction loans being riskier than loans for permanent structures. Below we illustrate the typical capital stack of a commercial property.

- 1st Mortgages refer to those most senior in the capital stack, typically offering the lowest risk and the lowest return. Investors in this exposure often refer to these assets as “Mortgage Income”.

- B-Notes exist in the subordinated (junior) tranche of the Senior Loans. These loans are second in the capital stack.

- Mezzanine Loans sit betweenthe equity tranche and the debt tranche, hence the “mezzanine” naming convention. This exposure is higher risk but also offers a higher yield, and most often offers investors floating rate payments.

- Equity the equity tranche is the lowest in seniority and therefore the first portion of the capital stack to absorb losses.

Real estate capital structure

Financing of a property can come from multiple sources. The term “capital stack” simply represents who gets paid first if the property owner defaults on their debt (and, conversely, who absorbs investment losses first).

Mortgage income may complement a core plus or even core fixed income allocation, given the higher-quality nature of this exposure, for investors who are able to accept the illiquidity, credit, and real estate risks. This compares to other parts of the real estate debt spectrum, such as mezzanine loans, which may provide a differentiated return-seeking exposure. Investment in the asset class also involves a lower duration profile relative to a traditional core bond holding, which may be attractive for investors who believe interest rates are set to rise and wish to lessen the interest rate risk in their portfolio.

Furthermore, some mortgage income strategies focus specifically on union labor-friendly investments and may loan funds solely to union developers, for example. This focus on union-built development and redevelopment projects helps create union jobs. These strategies can be particularly attractive to Taft-Hartley funds that wish to align investments with their institutional values.

Defining the asset class: benchmarking

Benchmarks in this space can be tricky, given its privately-traded nature. Benchmarking options are fairly limited. The strategies we follow use a core fixed income benchmark (Bloomberg U.S. Aggregate), which we describe below, along with an additional private benchmark possibility.

Mortgage income managers typically benchmark their strategies against the Bloomberg U.S. Aggregate. This is not perfect fit, as the Aggregate is composed of risk-free U.S. Treasury bonds and other risk-free government securities, rather than 1st mortgages or credit. Only 2% or so of this index is comprised of commercial real estate debt securities. However, as we mentioned, the available benchmarks in this space are limited. Investors who lean on the Bloomberg U.S. Aggregate as a benchmark for their broader fixed income book, such as is stated in the Policy Index, may also argue for the use of the U.S. Aggregate Index.

An additional benchmarking option is the Giliberto-Levy Index. This index represents the performance of actual privately-traded mortgage incomeassets. More specifically, it tracks fixed-rate, fixed-term senior loans that are made by and held in the investment portfolios of institutional lenders such as pension funds and life insurance companies. In other words, this index tracks the performance of a mortgage income peer universe. Index returns are market value-weighted, including a blended mix of apartment, office, retail, industrial, mixed-use, and lodging properties. The index contains only senior loans, across 82,000 total loans with a principal of $883 billion, since 1993. This benchmark is in our view the best fit to mortgage income, though access requires an annual subscription fee. This fee may deter cost-conscious investors or those with a smaller allocation to real estate debt. This index also provides transparency into certain investment characteristics of real estate debt, which is particularly enlightening as these sorts of metrics can be difficult to find for a privately traded (less transparent) asset class. Below we reference a few of those metrics from the Giliberto-Levy Index profile4.

- Coupon rate 4.21%

- Yield to maturity: 3.63%

- Remaining term: 7.5 years

- Average life: 6.43 years

- Modified duration: 5.33 years

Source: Giliberto-Levy Commercial Mortgage Performance Index (G-L 1)

Is real estate debt risk-seeking or risk-diversifying?

If mortgage income managers benchmark their strategies against a high-quality bond index (Bbg U.S. Aggregate Index), should investors assume this asset class is safe and will provide risk-diversifying benefits during bad times? In our experience, this tends to be a reasonable assumption during most market environments. Professionals in the asset class often describe the investment as acting like fixed income during good times, but potentially acting like real estate during bad times. In other words, investors might expect some losses during very stressed markets. But, as discussed in this paper, mortgage income assets are among the highest quality within the broader real estate debt spectrum. The technical reason for their high quality relates to where the assets sit in the capital stack. This was apparent during the 2008-2009 Global Financial Crisis, as mortgage income strategies generally saw only mild losses (up to a -10% fund loss, in our experience) despite extreme losses in property values.

This leads us to believe that mortgage income is somewhat of a risk-diversifier but with a bit of potential real estate tail risk.

Interpreting risk is tricky

Interpreting the stated volatility of mortgage income strategies is tricky. This is because, as with all privately-traded assets, the reported volatility of private assets understates the true risk of those assets, due to appraisal-based pricing and lag effects5. Investors do not know the true volatility of assets that are not traded daily on a market exchange.

The question of whether the true risk of mortgage income is closer to manager-reported volatility, or whether the true risk is closer to some publicly-traded proxy (Bbg US CMBS Index, for example, though this publicly traded index contains lower quality loans) is where reasonable folks can disagree. We believe that the answer often rests somewhere in the middle. Either way, investors should be aware of these characteristics in the context of the reported volatility of mortgage income strategies.

Our approach to mortgage income

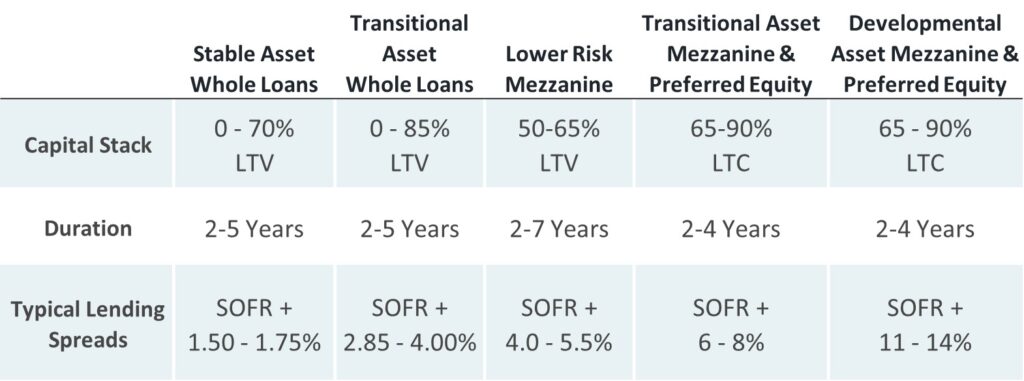

As mentioned, real estate debt is a broad asset class category that contains many types of exposures, ranging from higher-quality loans to higher-risk leveraged loans, from stable assets versus transitional or development, with an accompanying range of risk profiles. Mortgage income should generally be thought of as a higher-quality core holding within this space, and may complement a core plus or even core fixed income portfolio, though investors should note the illiquidity, real estate, and credit risks involved.

Verus approaches due diligence in this space similarly to the way we might for traditional credit or real estate. We seek stable firms with good reputations, reasonable fees that are appropriate for the strategy employed, and a solid track record. Although investments in this space are generally privately traded, some strategies offer monthly liquidity. We also look for proper risk controls and a diversified portfolio. A unique characteristic of this asset class worth noting is the very small universe of strategies—only a handful of managers compete in this space.

During our discussions with managers we not only seek skill in managing debt and loans, we also seek expertise in managing physical properties. This is important due to the fact that real estate debt managers may ultimately take ownership of properties if credit defaults occur. For example, following the 2008-2009 Global Financial Crisis and the property defaults that ensued, many managers effectively took control over real estate and become property owners—in some cases these properties took as long as a decade for the manager to offload. Therefore, both skills are relevant.

Conclusions

Mortgage income is backed by properties as collateral and generates returns through the interest rate on the debt and fees paid by the borrower. An argument can be made that this asset class is a fixed income allocation since it is an investment in debt, while a separate argument can also be made that it is a real assets/real estate allocation since it is an investment in real estate (though in a different layer of the capital structure). Mortgage income may complement a core plus or even core fixed income allocation, given the higher-quality nature of this exposure, for investors who are able to accept the illiquidity, credit, and real estate risks. Strategies which focus specifically on union labor-friendly investments can be particularly attractive to Taft-Hartley funds that wish to align investments with their institutional values. Investors may be well-served by keeping in mind that the stated volatility of mortgage income is artificially low due to appraisal-based pricing and lag effects. Verus not only seeks skill in managing debt and loans, we also seek expertise in managing physical properties, as mortgage income managers may ultimately take ownership of properties if credit defaults occur. For more information regarding our approach to this asset class, please reach out to your Verus consultant.

1 Additionally, many investors think about mortgage income as a part of a broader private credit portfolio.

2 Fees can come in the form of origination fees and also prepayment penalties.

3 U.S. Board of Governors, Federal Reserve. As of June 2021

4 As referenced from Jblevyco.com on February 17th 2022. Index metrics updated March 30, 2020

5 Private assets are not regularly traded and therefore do not have a market price. To estimate the true value of private assets, a third party appraiser is typically hired periodically to estimate the value of those assets. This creates two issues for the calculation of investment volatility (risk): First, the pricing of these assets is too infrequent to calculate volatility using standard methods. Second, it is commonly acknowledged that those third-party appraisers tend to “anchor” the new appraised asset value to that asset’s recently appraised value. This means that appraisals often understate the volatility of asset values.