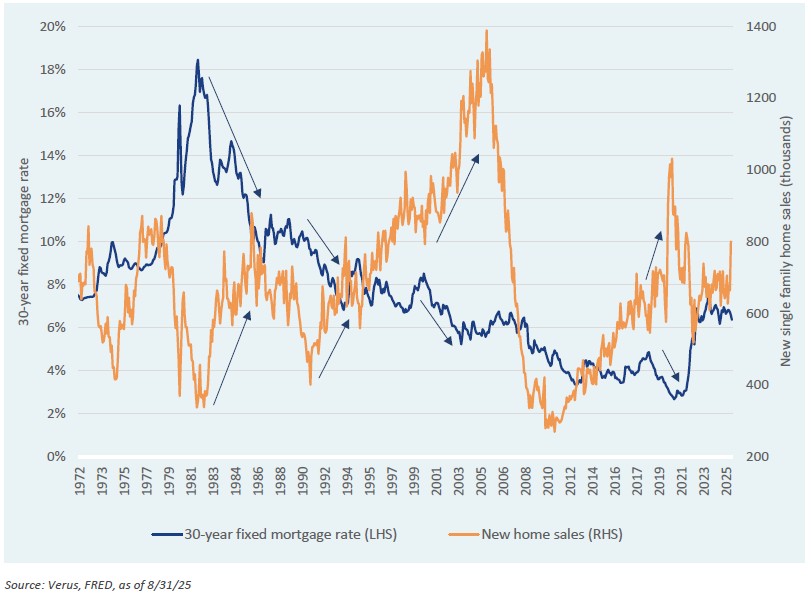

Home affordability has been near record lows, as high prices and elevated mortgage interest rates created an extremely difficult environment for new home buyers. The inventory of unsold newly built homes has also been rising as builders face slow sales. However, in August new home sales activity rocketed higher, up +20.5% from just a month earlier. This was the third largest monthly gain since the 2000s housing boom. The 30-year fixed mortgage rate has fallen from 7% at the beginning of the year to around 6.35% today, and now many Americans expect the Federal Reserve to engage in a series of rate cuts which may further help affordability.

In this week’s Market Note, we outline the historical relationship between new single family home sales activity and the direction of mortgage rates. Specifically, a sustained period of falling borrowing rates often coincides with accelerating home sales. Given the pent-up demand for homeownership today, this relationship may prove particularly strong.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.