Many market participants expected the Fed to announce a moderate 25 bps interest rate cut. Instead, the Fed on Wednesday went ahead with a larger 50 bps cut. Investors are cheering on what is likely to be an extended series of rate cuts, and excitement abounds for an economic soft landing. Market attention will now likely turn to the labor market and how conditions evolve, which will be key for the Fed’s future rate path.

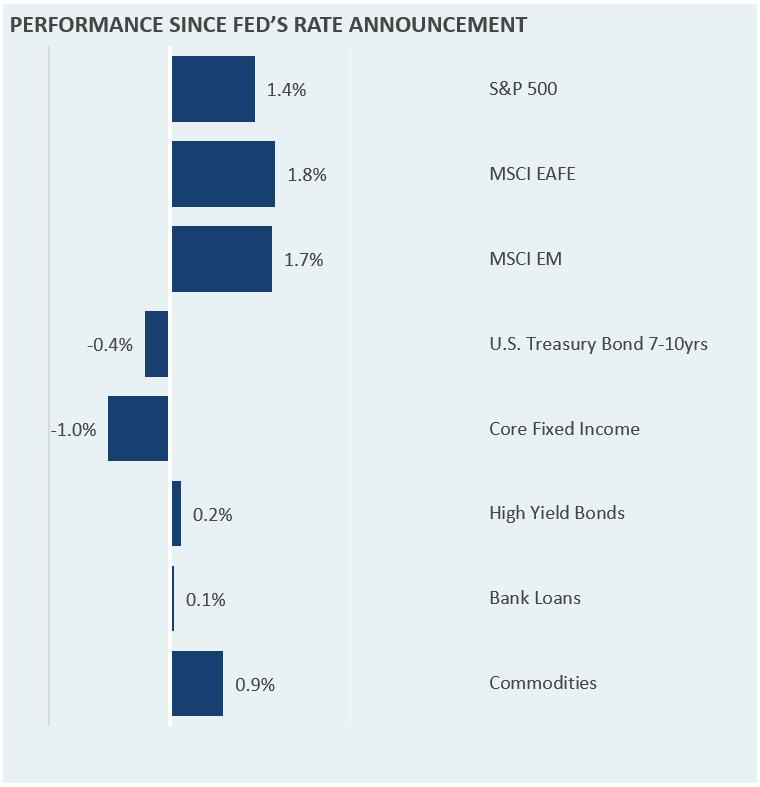

The market reaction to the Federal Reserve meeting was fairly muted. Treasury yields have slightly increased since the announcement. However, the S&P 500 set a new all time high on Thursday, and risk assets around the world have broadly rallied.

In this week’s Market Note, we highlight major asset class performance since Wednesday.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.