Download the Topic of Interest (PDF)

Low interest rates over the last few years have caused investors significant asset allocation problems. The 2022 market reversal has begun to reverse these challenges.

The implications of this return to more normal conditions for investors include:

- The renewed role of fixed income in portfolios

- Greater flexibility to meet performance objectives through simple portfolio structures

- The ability of certain investors to meet return objectives while taking less market risk

- The potential for pensions to take advantage of higher interest rates and likely stronger funded status by pursuing more liability-aware investment strategies

The market reversal of 2022

Since the interest rate peak in the early 1980s bonds were an exceptional investment, offering the dual benefits of strong returns (falling interest rates pushing bond prices up) and diversification (sharp drops in interest rates during each market crisis resulting in windfall returns from bonds). However, this trend seemed to end during the fast-spreading global pandemic of 2020, as most central banks quickly lowered interest rates all the way to 0%¹ to provide support to the crisis-hit economy. This resulted in a collapse of the expected return of bonds, and therefore cast doubt on the ability of bonds to act as a return driver and diversifier in portfolios. We described this changing market dynamic and suggested how investors might respond to it in our recent piece Is Painless Diversification Dead?.

This all changed in 2022.

During the past year, central banks began a seemingly coordinated campaign of interest rate hikes, with the aim of fighting high inflation in their local economies. In the United States, the yield of cash and the yield of 10-year Treasuries are now at levels not seen since the 2000s. The normalization of interest rates, discussed for years, seems to be happening at last.

A higher interest rate environment

Both central bank communications and market expectations suggest that this new higher interest rate environment is here to stay. At the same time, quantitative easing during the economic crises of the last decade had led central banks to accumulate massive balance sheets which they are now attempting to unwind. The sale of trillions of dollars of assets―mostly bond instruments―is likely to provide further support for higher interest rates.

What are the implications for investors?

A structural change in the behavior of fixed income is important for institutional investors for two reasons. First, it tends to be a large exposure in most institutional portfolios, and second, fixed income is typically the greatest ballast to risk assets during rough market times. There are four ways that we believe this change might impact investors and their behavior.

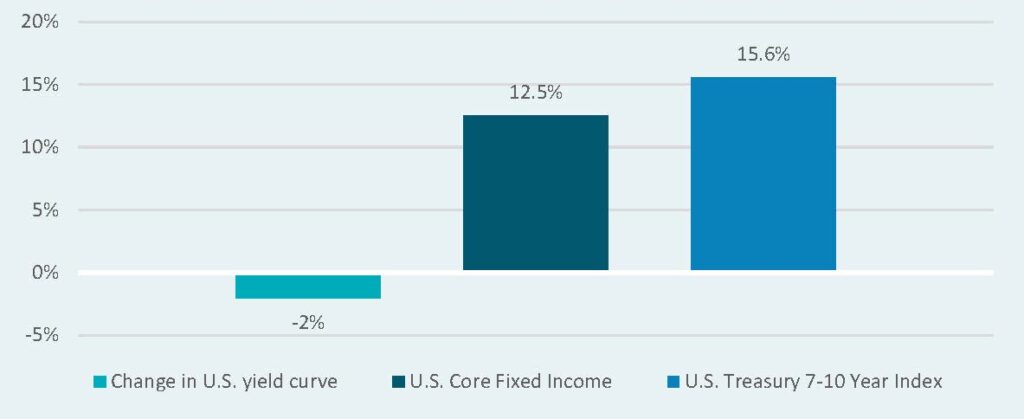

- First, the 2022 market reversal seems to re-establish the role of bonds in portfolios. An investor can once again hold an allocation to high-quality fixed income and expect diversification from those bonds during the next market crisis—with bond yields well above 0%, the diversification downside protection benefit of duration has returned. To illustrate, we can assume that, as long-term interest rates have on average fallen by 2% during economic slowdowns of the past2, similar behavior might happen again in a new slowdown. In such a scenario the potential performance of bonds would be impressive, as shown below. Note that these downside-protection performance figures would be received in addition to the yields that these bonds are currently offering. In other words, painless diversification may be back3.

Sensitivity of fixed income to a 2% decline in interest rates

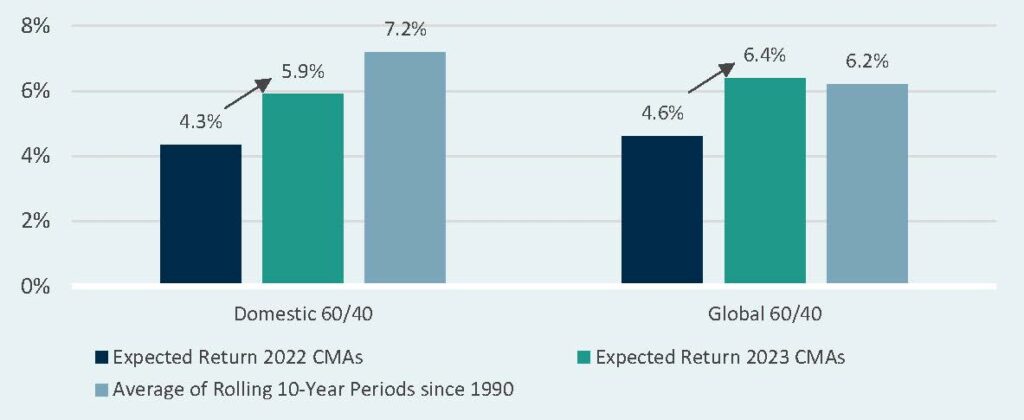

- Second, the 2022 market reversal has substantial knock-on effects for future expected asset class returns across the whole asset universe – not simply fixed income. A dramatically improved investment outlook, with both higher expected equity return and the ability to generate higher returns from high-quality fixed income, gives investors much more flexibility in their asset allocation decisions. A traditional, simple, cost-effective structure such as a 60/40 portfolio may now offer sufficient future returns for many investors to meet their return objectives. Below we illustrate the increase in expected returns for a domestic 60/40 and global 60/40 portfolio, based on Verus 10-year Capital Market Assumptions. It is notable that a global 60/40 portfolio now offers prospective returns higher than the average experienced in 10-year periods since 1990. This allows investors to focus less on unnecessary complexity in portfolio structure, and potentially adopt simpler and cheaper portfolio solutions.

Rising capital market assumptions

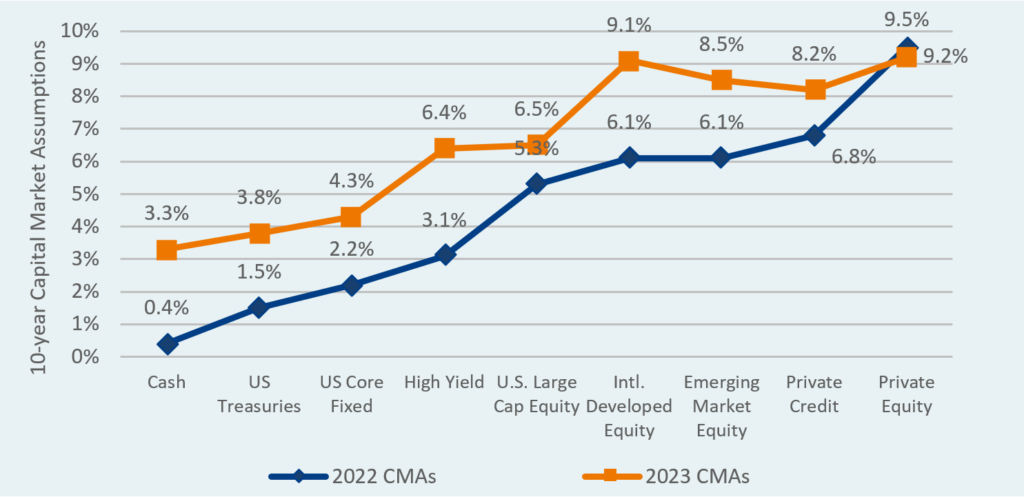

- Third, investors may not only be able to lean away from complexity, but may also now be able to meet return objectives while taking less market risk. The COVID-19 pandemic and subsequent global ultra-low interest policies resulted in a collapse of expected returns across all asset classes. This effect is shown by the blue line below. In that environment, bonds and diversifying assets offered such low returns that many investors were pressured to reach for yield, moving their funds away from safer assets towards riskier exposures that would better contribute to portfolio return objectives. The market reversal of 2022 alleviated much of this pressure, as demonstrated by the orange line. Higher asset-class return expectations may now allow investors to meet return targets while taking more moderate levels of market risk.

The risk curve has been lifted

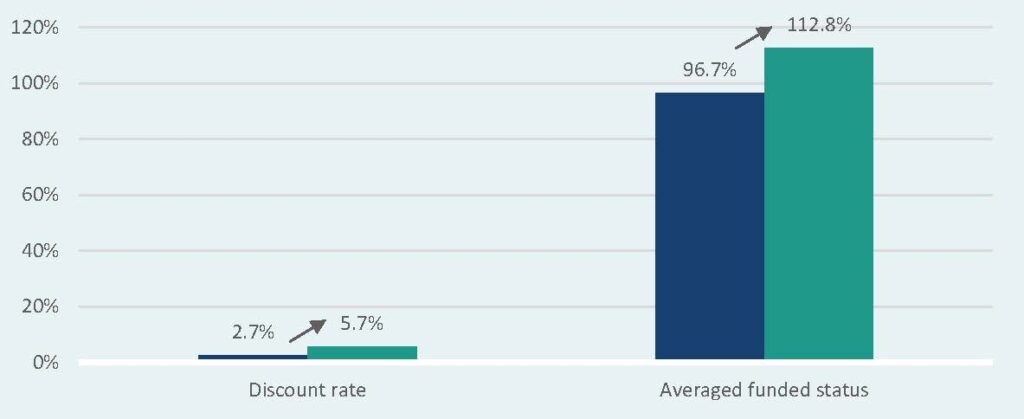

- Finally, higher interest rates have pushed funded status upward for pensions with interest rate-sensitive liabilities. According to the Milliman Pension Funding Index, corporate pension funding ratios have improved from 96.7% to 112.8% from November 2021 to October 2022, as discount rates increased from 2.72% to 5.71%. Improved funded status allows greater flexibility to pursue liability-aware investment strategies. Higher bond yields also make this approach more attractive for underfunded pensions, as the bonds that are used to match pension liabilities have higher yields with which to contribute to pension return targets.

Greater opportunities for liability-driven investing (LDI)

Conclusions

The rise of interest rates throughout 2022 has reversed the multidecade trend of falling yields. Short-term interest rates (cash) and long-term interest rates (10-year U.S. Treasuries) are at levels not seen since the 2000s. There are four key implications of higher interest rates for investors: First, fixed income may once again provide the dual benefits of diversification and return generation, greatly improving its attractiveness as an asset class. In other words, we believe that painless diversification may be back. Second, the investment outlook has markedly improved. A traditional, simple, cost-effective structure such as a 60/40 portfolio may offer sufficient future returns for many investors to be able to meet their return objectives. Third, investors may now be able to meet return targets while taking less market risk. The need to reach for yield by pursuing riskier and less liquid assets has been mitigated, at least partially. Finally, for those institutions with portfolios that exist to defease future liability payments, improved funded status may allow greater flexibility to pursue liability-aware investment strategies.

This new higher interest rate environment is likely here to stay, as indicated by central bank communication, market expectations, and the broad efforts of central banks to wind down their massive balance sheets. Investors can usefully spend part of 2023 focusing on adjusting their portfolio to take advantage of this new environment.

1 Materially below 0% in many developed countries

2 This is, of course, a very rough approximation, as interest rate movement has varied based on the unique qualities of each economic environment of the past

3 Please read our original whitepaper Is Painless Diversification Dead? (https://www.verusinvestments.com/is-painless-diversification-dead/) if you are unfamiliar with this phrase