Download the full Topic of Interest (PDF)

Download the short summary (PDF)

Executive summary

For those clients who are comfortable embracing the complexity of hedge funds, we continue to believe that these strategies can play an important role in institutional portfolios and deserve a seat at the table. Furthermore, the justifications for these strategies may be strengthening as we enter a much different market regime. In this research paper, we first lay out the market environment of the past decade and its impact on hedge fund behavior. Then, we discuss the current market environment and what this may suggest for the hedge fund opportunity set going forward. Finally, we present two effective methods of hedge fund implementation and the characteristics of each. Evolving market conditions suggest that hedge funds will be more competitive relative to traditional market returns over the next 5-7 years, and investors would be well advised to consider whether they can have a role in their portfolios.

A changing market environment

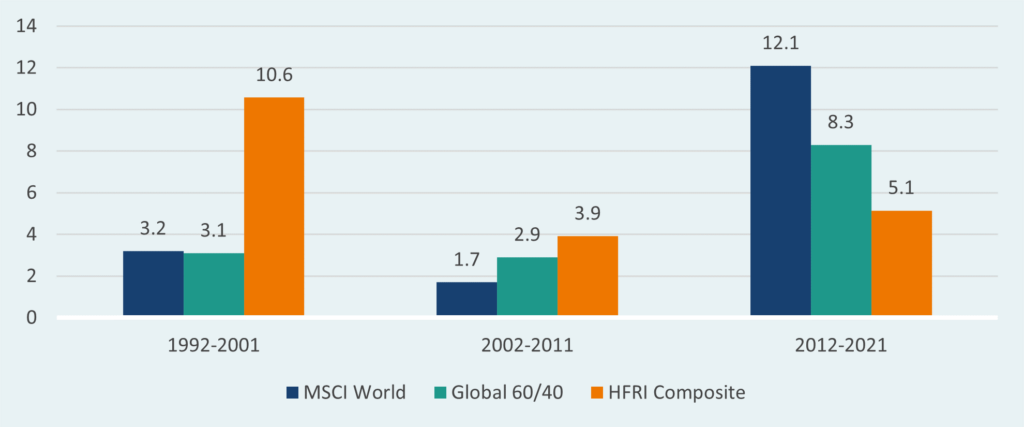

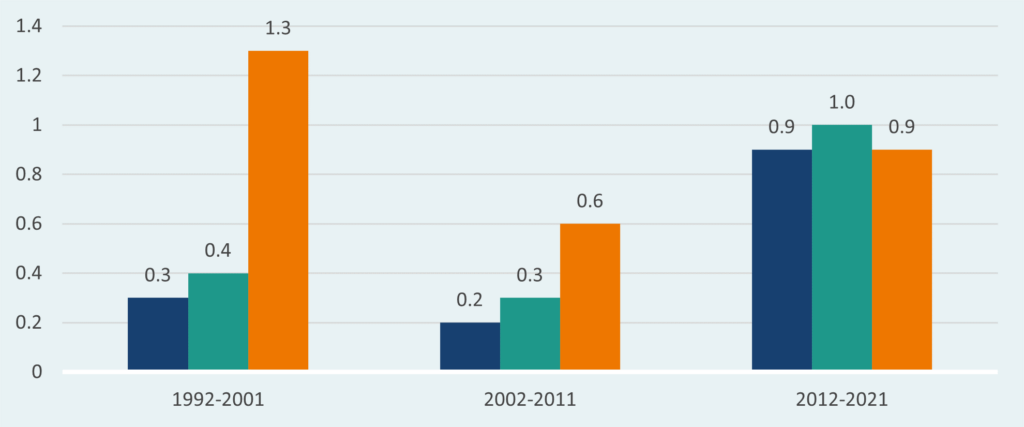

The ten years leading up to the current interest-rate cycle were tremendous for equities and traditional portfolios both on a cash plus basis and compared to their history. How did hedge funds do during this time? Fine. Not great, not terrible. With their diversification benefits, hedge funds remained a valuable option at the total portfolio level.

Exhibit 1. Annualized return, excess vs. cash

Exhibit 2. Sharpe ratio

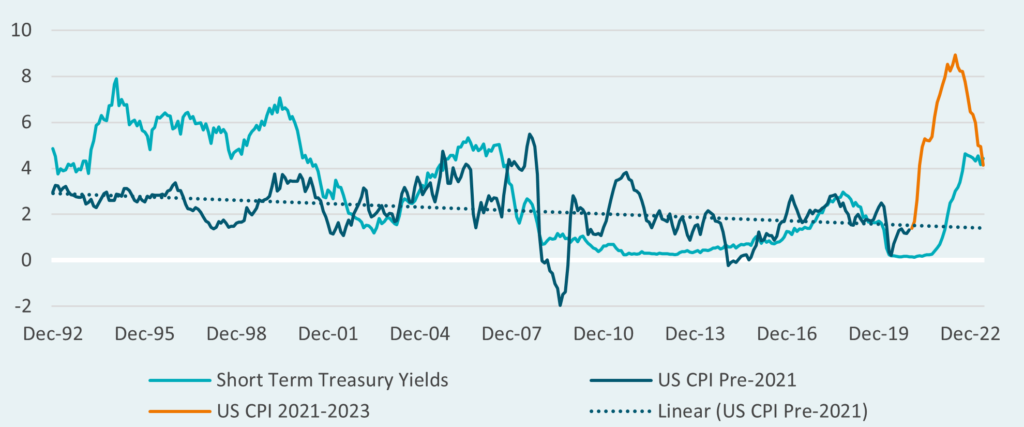

The 2012-2021 market period was marked by unprecedented central bank intervention (Zero Interest Rate Policy & Quantitative Easing), supportive fiscal policy, ongoing globalization and subdued geopolitical risk, and a post-Global Financial Crisis rebound. But the world changed in the aftermath of the COVID-19 pandemic which ushered massive monetary easing and fiscal stimulation. Tailwinds became headwinds as the market faced a combination of high inflation, high interest rates, geopolitical risk/war, and deglobalization trends. These are all readily known – what is unknown is the magnitude and duration of their effects on markets. Even if we assume a neutral effect from two key variables – interest rates and inflation – we can fairly conclude that the biggest tailwinds to markets from the last decade are gone in the shorter term, even though over a 10-year basis, expected capital market returns increased modestly over the expectations from the previous year.

Exhibit 3. U.S. treasury yields vs. CPI YoY

Looking forward

What does the future have in store for hedge funds? There are three factors to consider: Beta, Alpha, and Implementation. For the Beta component, any headwinds for markets are generally headwinds for hedge funds, which, viewed in aggregate, have a low but consistent equity beta of 0.3-0.4. Second, regarding Alpha, some headwinds for markets are actually tailwinds for the opportunity set used by hedge funds to extract absolute returns, including a boost from higher cash yields. Third, a proper Implementation can maximize the impact from the expected divergence between market and hedge fund returns.

Beta

The Beta factor is straightforward: headwinds for markets are generally headwinds for hedge funds in terms of total return. But given the low beta of hedge funds, there is great opportunity to outperform markets during market drawdowns. The 2002-2011 period (see Exhibit 1) is a great example of a challenging period for equity markets where hedge funds outperformed. The duration of any negative equity market environments is also relevant: short-term shocks (Lehman, COVID to some extent) can also be painful for hedge funds as liquidity is rapidly pulled out of the market. However, intermediate to longer-term drawdowns (or even flat market performance) allow hedge fund positioning to adapt and take advantage of directional trends, or for market-neutral arbitrage strategies to stack up and compound returns even as markets remain subdued.

Alpha opportunity

We believe that some of the headwinds for markets are actually tailwinds for the opportunity set used by hedge funds to extract absolute returns. A few examples:

- Corporate Stress and Dispersion: High borrowing costs, slowing growth, and withdrawal of liquidity from the financial system should lead to increasing corporate stress. The higher rates go, and the longer they stay high, the more problems they create for companies optimized for an easy-money environment. This drives the opportunity set for fundamental equity and credit investors across the entire portfolio. Even if markets do not enter a true distressed cycle, the transition towards real consequences for poorly run companies should present opportunities for actively managed strategies such as hedge funds.

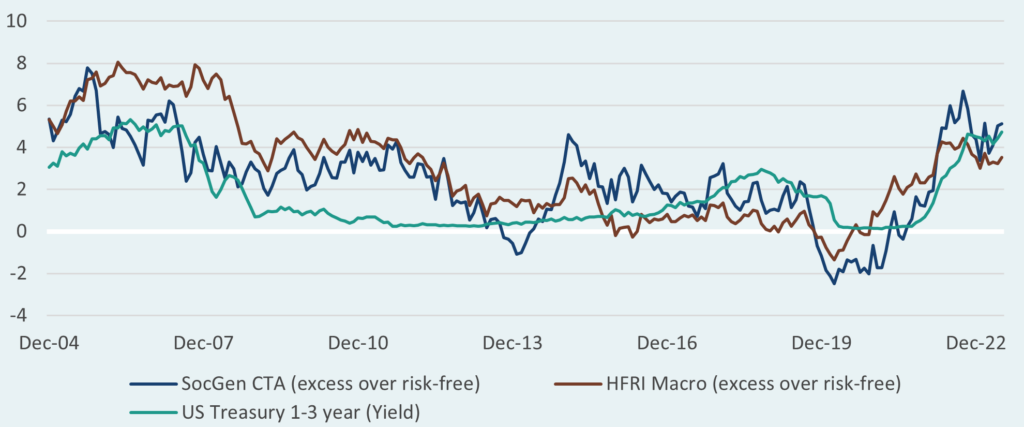

- Inflation and Central Bank Action: The years following the GFC were challenging ones for global macro strategies as central banks kept interest rates at zero almost indefinitely (see Exhibit 4). The world has changed since then. Macro traders have more recently demonstrated their value by predicting central bank actions and capitalizing on resulting uncertainty, which, of course is not possible when central banks are not doing anything (see Exhibit 5). Similar arguments for CTAs and other systematic strategies can be made that the more central bank activity, and the more dispersion across global markets, the better the opportunity set.

Exhibit 4. Rolling 5-year annualized returns for macro and CTA funds vs. short-term treasury yields

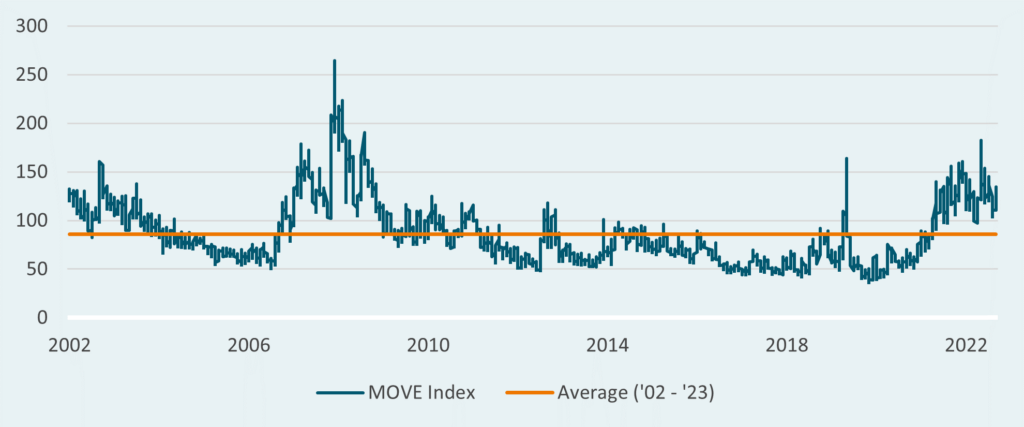

Exhibit 5. Implied volatility in U.S. treasury yields

- Cash: Cash is admittedly not a source of alpha in any sense, but cash return levels do impact total returns. Any hedge fund using leverage or shorting (which is most of them) now earn significant yields on any cash balances. Futures-based strategies, such as CTAs, will often have more than 50% of their NAV in cash. Heavy options-based strategies, such as Macro, are seeing option premium offset by cash yields. Spread-based arbitrage strategies should see a proportionate increase in spreads, and short interest carry for long/short equity funds is now a meaningful contributor for the first time since before the GFC.

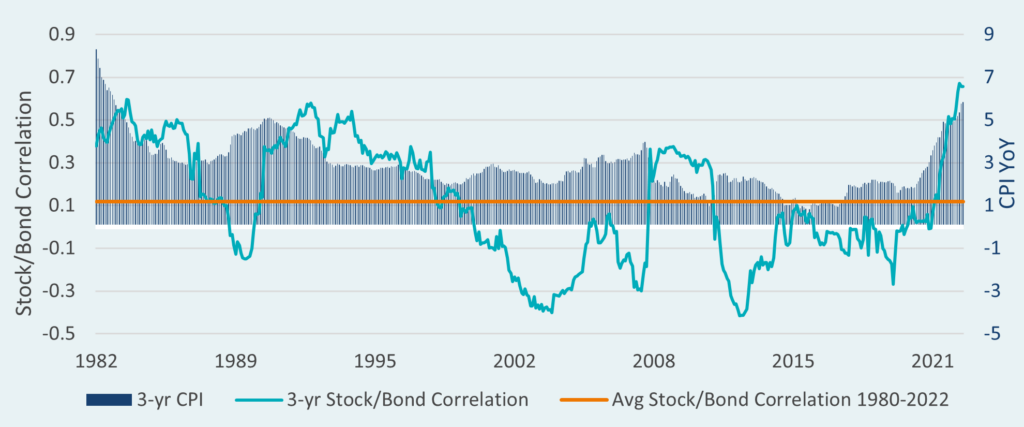

- Volatility and Tail Risks: Downside risks may remain elevated in the near-term for well-accepted reasons: real economic risk exists while equity and credit markets appear to be pricing a perfect resolution to the inflation issue. Additionally, the diversification power of bonds may not be as reliable amid recent Federal Reserve dynamics. Given all these, we believe hedge funds may be a more effective tool to diversify risky assets in this environment.

Exhibit 6. Stock/bond correlation vs. CPI since 1980

Implementation

We continue to stand by our philosophy that hedge funds are not an asset class, and that the variability between strategy types and the individual funds within those strategies is enormous. In practice, hedge fund investing is not a simple box-filling exercise. It is a deliberate choice of finding the best managers to fit in specific roles within a total portfolio, regardless of their “category.” There are many exotic roles that hedge funds can play in today’s institutional investor universe: tail risk, opportunistic, downside protection, and more. The two roles we believe will be most impactful going forward are what we call Absolute Return and Inclusion.

Absolute Return

This is a modification of the traditional “asset class” or single line-item hedge fund approach and, as such, requires some policy treatment as a distinct allocation separate from other asset classes. Each investor should work to define the objectives of their hedge fund approach clearly. Objectives may include portfolio diversification or simply a cash-plus return target. Other considerations around objectives may include convexity, income/yield, or downside capture, and limitations like required liquidity. In many cases, items such as fees, leverage, or other similar issues may be minimized by putting clear and consistent emphasis on a client’s net returns (this also applies to the Inclusion approach, but doubly so here). Portfolio objectives and constraints are different for each client, but our starting point for reasonable risk and return targets ends up at around 4-5% over cash returns with a beta to equity and credit markets of 0.3 or less and a correlation of 0.6 or less over a full market cycle. Portfolios should be diversified across as many alpha sources as possible using the most capable managers to consistently achieve these objectives. Typical portfolios will range from 12 to 20 funds, mostly from the relative value, multi-strategy, and macro categories.

Inclusion

The Inclusion approach involves investing in, benchmarking, and thinking about, hedge fund investments in line with the asset class in which they are trading. For example, an investor would include equity-focused hedge funds in the public equity sleeve of their overall portfolio, credit-focused hedge funds in the credit sleeve, etc. For the Inclusion approach, the investable universe is comprised of funds that primarily invest in equity or credit securities and produce returns that consistently include some beta and some alpha. Relative to traditional long-only funds, Inclusion funds use both a higher degree of active management skill (e.g., leverage, shorting, financial/operational structure influence) which is applied to a broader investable universe (e.g., hedge funds will have high tracking error due to their benchmark insensitivity). In equity, the hedge fund investment thesis puts great emphasis on the extension of active management skill relative to traditional long-only funds. We expect that shorting will be a particularly valuable talent in this new environment as the impact of higher rates drives dispersion between winners and losers across the market. The universe of securities can be marginally wider and may include some private exposure. In general, it is preferred to build a portfolio of funds that outperform an identifiable market benchmark over a full cycle. This was a more difficult task in the high-flying 2010s, but we expect that the go-forward market environment will be more favorable.

In credit, we believe the extension of active management still applies but is augmented by an even wider and more complex universe of public and private securities, offering even more paths to outperformance. A diverse group of strategies are available, such as credit arbitrage, structured credit, long/short credit, distressed/restructuring, and even private credit. Again, with the Inclusion approach the goal is to outperform traditional credit and fixed income benchmarks, not peer composites. And because these strategies can apply a high degree of skill in an even broader universe, we find that credit hedge funds can offer both significant diversification impacts and return enhancement.

We believe that both Absolute Return and Inclusion allocations should be considered as a long-term, strategic part of portfolios, and not as a source of liquidity unless absolutely necessary. In our view, manager selection is the ultimate determinant of success, and investors should take great strides to preserve or obtain capacity in top funds.

Conclusion

For those clients who are comfortable embracing the complexity of hedge funds, we continue to believe that these strategies can play an important role in institutional portfolios and deserve a seat at the table. Furthermore, the justifications for these strategies may be strengthening as we enter a much different market regime. In this research paper, we first laid out the market environment of the past decade and its impact on hedge fund behavior. Then, we discussed the current market environment and what this may suggest for the hedge fund opportunity set going forward. Lastly, we explained two effective methods of hedge fund implementation and the characteristics of each. Evolving market conditions suggest that overall hedge funds will be much more competitive relative to traditional market returns over the next 5-7 years. Investors who do not currently use hedge funds should reconsider the benefits in the new market environment, and those already invested may use this opportunity to refine their scope and objectives and increase allocations as appropriate. For more information regarding our hedge funds views, please reach out to your Verus consultant.

Disclosures

Past performance is no guarantee of future results. This report or presentation is provided for informational purposes only and is directed to institutional clients and eligible institutional counterparties only and should not be relied upon by retail investors. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited only and are subject to change without notice. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. This report or presentation cannot be used by the recipient for advertising or sales promotion purposes.

The material may include estimates, outlooks, projections and other “forward-looking statements.” Such statements can be identified by the use of terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” or the negative of any of the foregoing or comparable terminology, or by discussion of strategy, or assumptions such as economic conditions underlying other statements. No assurance can be given that future results described or implied by any forward looking information will be achieved. Actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Risk controls and models do not promise any level of performance or guarantee against loss of principal.