Download the Topic of Interest (PDF)

Introduction

Fixed income investors seeking higher return potential and increased portfolio diversification often choose to allocate to credit as a solution. An investor’s approach to taking on credit exposure, and the type of exposure that is appropriate, should take into account current credit conditions and the investor’s market outlook. As credit conditions are beginning to change, perhaps significantly, and risks of defaults and distress may also be bubbling up, we believe investors should be assessing their fixed income positioning and perhaps considering other opportunities across the credit spectrum outside of traditional core fixed income. Despite changing market conditions and potential headwinds, we believe that the credit risk premium is persistent, and investors benefit over time from maintaining an allocation to credit.

Mechanics of the credit risk premium

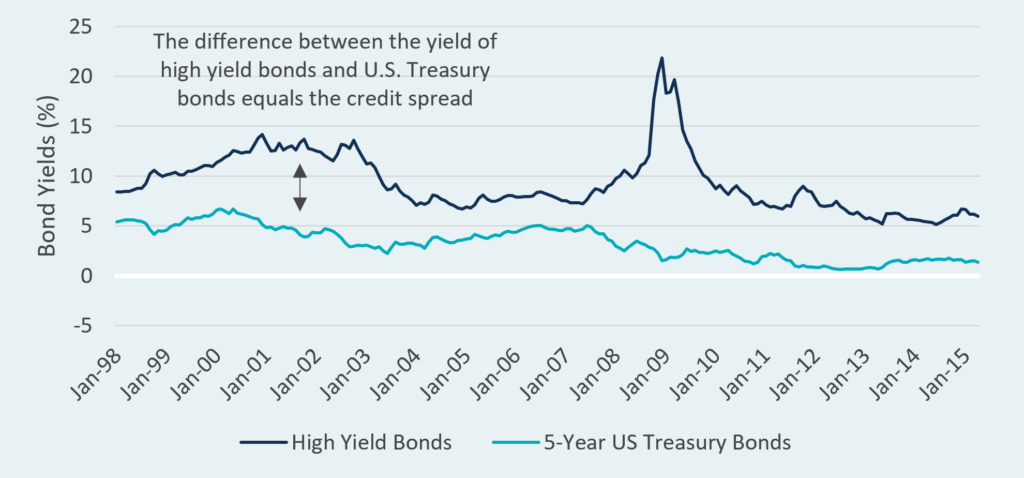

To justify an allocation to credit, investors require additional spread to compensate for the possibility of bond defaults and distress. This compensation is referred to as the credit risk premium (CRP) and comes in the form of additional spread over comparable risk-free assets (U.S. Treasury bonds). Historically, credit spreads have varied inversely to the economic cycle and are usually magnified during periods of market stress as expectations of bond defaults increase and as liquidity is removed from the market. Conversely, during periods marked by stable to improving economic conditions, credit spreads are narrow as investors’ expectations of future bond defaults decline.

High yield spreads vs. U.S. treasury yields

While over the long-term investors benefit from maintaining exposure to credit, during periods of increasing market volatility, investors can experience significant losses, but are also presented with attractive entry points to invest new capital. Historically, credit spreads have been very sensitive to changes in market dynamics. As conditions deteriorate, investors demand additional spread (higher bond yields) to own credit based on their expectations regarding the potential for greater defaults and lower recovery rates1.

While there have been a number of periods in which credit spreads have widened, none is more prominent than during the Great Financial Crisis (GFC) in 2008-2009. As markets dislocated and liquidity was withdrawn, the yield demanded by investors on high yield bonds in some cases exceeded 20%. Despite rising default rates and lower recovery rates, investors experienced solid relative returns during the period. Importantly, credit markets have historically exhibited a mean-reverting tendency, with both yields and defaults falling as markets normalize and expectations of future defaults subside. As a result of this, investors who are capable of taking advantage of dislocations are likely to be rewarded for the additional risk taken.

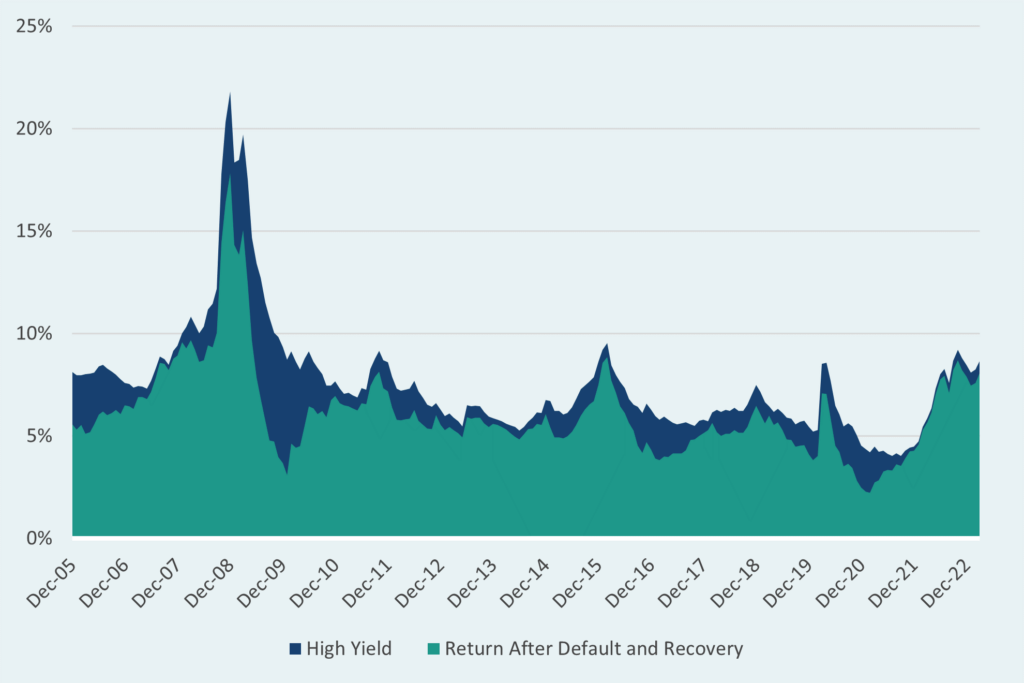

High yield spreads and return after defaults and recovery

Have we entered a new credit regime? A look at the new environment

Following the onset of the GFC, global central banks and governments supplied monetary and fiscal stimulus that was designed to reassure investors and provide liquidity. As a result, the credit spread required by investors slowly declined as confidence in the markets increased and business conditions strengthened. Importantly, improving economic conditions contributed to increasing corporate profitability which drove down both credit spreads and default rates.

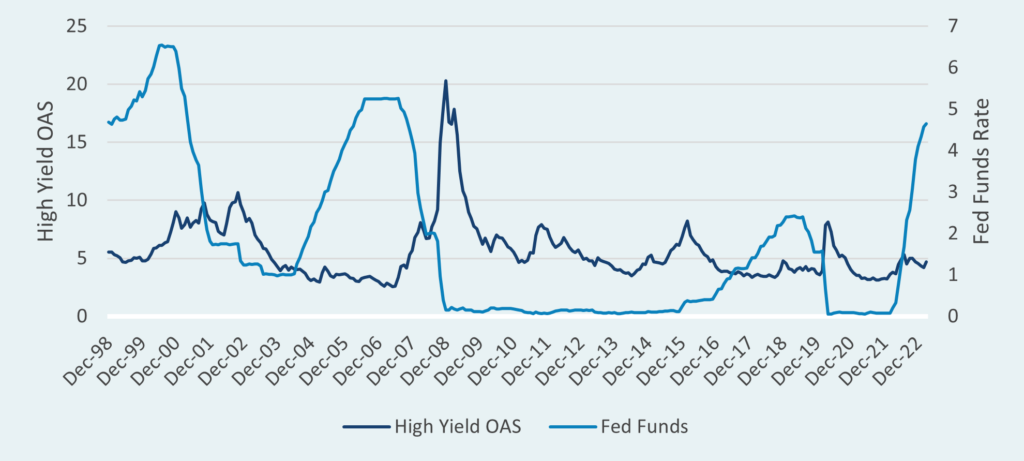

During the market events displayed below, a pattern can be seen where periods of increasing market stress, as marked by rising credit spreads, is followed by changes in monetary policy by the Federal Reserve Bank (the Fed). Falling interest rates allow levered companies to refinance their debt at lower rates which improves profitability and lowers the probability of default. However, more recently during the onset of the pandemic in 2020, the size and scope of the response required was significantly larger than anything the market had previously seen. While credit spreads did increase meaningfully as the risk-free rate approached 0.0%, defaults were not meaningfully higher than what was previously experienced. However, the policy response set the stage for a change in investors’ expectations for both credit spreads and inflation.

The impact of interest rates on high yield spreads

Where are we now?

Following the unprecedented policy response by the Fed and other global central banks, inflation increased significantly as the prices paid by consumers for goods and services rose quickly. While the negative impact on consumers was material, risk assets, and credit specifically, recovered quickly as credit spreads narrowed to their pre-pandemic levels in less than 12 months. However, concerns about persistent inflationary pressures forced the Fed to quickly pivot and begin tightening monetary policy by raising interest rates. Rising interest rates have historically been a headwind for credit. Not surprisingly, corporate bond issuance fell dramatically because of liquidity being removed from the market and because of rising borrowing costs.2

History of U.S. inflation

More recently, credit growth was hampered following the collapse of several regional banks that were key in providing funding to small-to-medium-sized businesses, in addition to facilitating lending to private equity firms. The primary cause of these bank failures was due to a mismatch between the bank’s deposit base and balance sheet assets. Despite interest rates rising, many regional banks failed to raise their deposit rates, making money market funds and other bank rates more attractive. During the pandemic, many banks purchased longer-dated bonds to maintain their expected income. These bonds fell in value as interest rates rose and were below their purchase prices. As a result, when deposits were withdrawn, many of these securities were sold for significant losses. While the tide of deposit flows has slowed, the impacts could be far-reaching. Many of these banks played a critical role in financial commercial real estate projects. While there may be private lenders who can step in and fill the gap left by banks, the resulting slowdown in credit creation could further affect the amount of premium required by investors to hold credit.

Opportunities and threats: A pending downturn in credit

While rising credit spreads can create mark-to-market volatility for investors, there are several strategies that are designed to take advantage of market conditions to create value for investors. In this section, we cover multi-sector credit strategies, distressed debt, and traditional high yield credit.

Multi-sector credit strategies invest in a broad opportunity set of investment grade and below investment grade corporate credit, in addition to securitized bonds across the credit spectrum. These products are designed to tactically rotate through sectors based on relative value assessments to increase potential return. While these types of strategies have the ability to buy securities at lower prices when markets move, historically many of these strategies have experienced drawdowns as they maintain exposures to credit throughout the cycle. That said, we appreciate the ease of implementation for investors who prefer to not take exposures to dedicated sub-strategies (high yield bonds, bank loans, and EM debt). Importantly, these strategies can serve as a completion portfolio for investors who traditionally allocated to only core or core plus fixed income strategies.

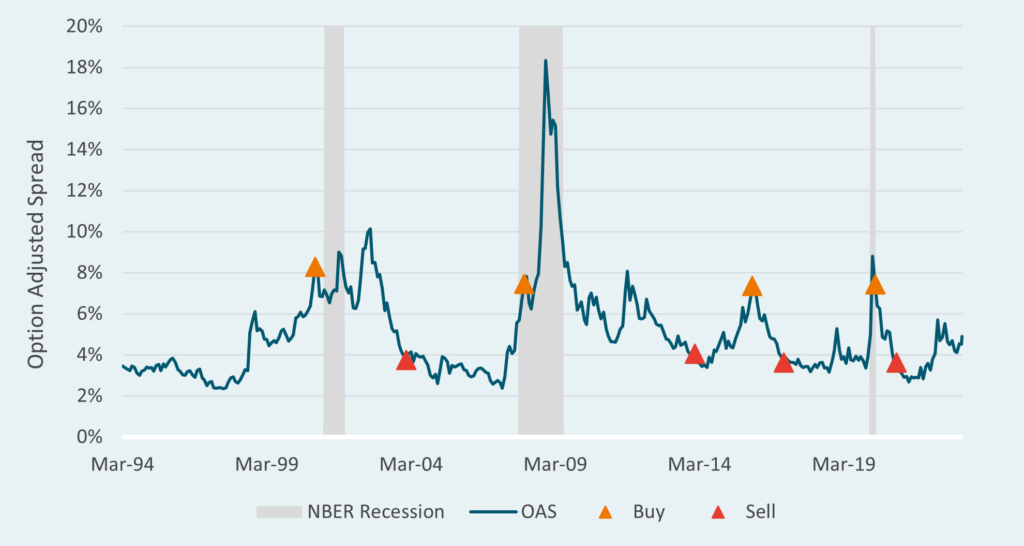

Distressed debt strategies focus primarily on below investment grade credits and are designed to tilt into risk during market dislocations. Historically, high yield bonds have traded with credit spreads remaining in a narrow range. However, during periods of stress when credit spreads widen significantly, these types of strategies seek to harvest the credit risk premium based on the expectation that markets will normalize and mean revert over time. Importantly, many of these strategies have systematic, pre-determined spread levels which “trigger” the investment process. Said differently, committed capital is only called when needed which limits opportunity costs and lessens portfolio friction.

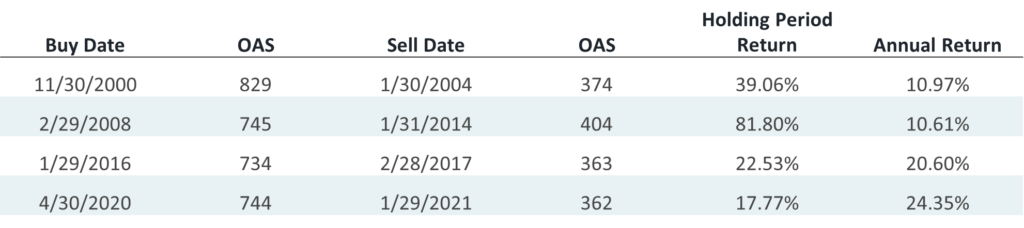

Looking at the historical performance of high yield spreads, this type of approach has been additive to investors. When examining the chart and table below, assuming investors allocate to high yield bonds one-month following spreads exceeding 600 basis points and selling one-month following spreads declining below 400 basis points, they would have experienced strong double-digit returns. While most of the performance can be attributed to the mean reverting nature of credit spreads, it is reasonable to assign some of the performance to the underlying structure of these funds. The contingent “trigger” removes some of the guesswork out of “timing” the implementation. For these reasons, we believe that these types of strategies can benefit investors seeking exposures to stressed or distressed credit in order to benefit from market dislocations.

Strong total return potential

Traditional high quality core fixed income strategies have historically provided investors with solid returns and low correlations to risk assets during periods of elevated market volatility. Many of these strategies use the Bloomberg US Aggregate Bond Index as a benchmark which is made up of roughly 70% US Treasury and Government Agency bonds. The purpose of core fixed income is to provide capital preservation and to be a source of liquidity. Often, investors use these exposures as a source of liquidity to fund more opportunistic strategies during market dislocations – effectively selling high and buying low.

One concern for investors during periods of market stress is active management. Often, managers will allocate to off-benchmark sectors with the goal of adding value relative to the benchmark. Market dislocations can sometimes be violent events, resulting in brief periods of illiquidity and significant drawdowns. Exposures to higher beta sectors such as below investment grade corporate credit, bank loans, or securitized bonds can result in strategies underperforming their respective benchmarks. However, over the longer term, these strategies have shown that mean reversion usually results in portfolios recovering their relative underperformance.

Time horizon matters

Credit markets offer investors a myriad of unique benefits for maintaining a strategic allocation. Most importantly, exposure to credit can improve the risk-adjusted profile of a diversified portfolio. The combination of higher relative coupons and lower duration compared to traditional core fixed income increases the portfolio’s return potential while also mitigating interest rate risk. Additionally, the evolution and growth of the investable universe of credit should continue to provide investors with opportunities to maximize the benefits of these attributes over the long term.

From a shorter-term, tactical perspective, credit has historically outperformed core fixed income during periods of economic expansion marked by strong economic growth. During these periods, credit spreads usually decline as concerns about potential defaults decrease. Conversely, credit typically underperforms core fixed income during periods of weak economic growth resulting in wider credit spreads. Investors can benefit from managing sector and interest rate risk exposures throughout the cycle by employing managers and strategies that have the ability to rotate through sectors based on valuations. For example, following an economic trough, as economic activity is increasing, expectations for rising interest rates and inflation have historically made allocations to floating rate securities, such as bank loans, attractive given their sensitivity to the economic and interest rate cycles. Conversely, as the peak of the economic cycle, investors could benefit from increasing their allocations to higher quality investment grade corporate credit or securitized credit which have typically outperformed lower quality credits during slowing economic growth or market dislocations.

Conclusion

Fixed income investors seeking higher return potential and increased portfolio diversification often choose to allocate to credit as a solution. We believe that an investor’s approach to taking on credit exposure, and the type of exposure that is appropriate, should likely take into account current credit conditions and the investor’s market outlook. As credit conditions are beginning to change, perhaps significantly, and risks of defaults and distress may also be bubbling up, we believe investors should be assessing their fixed income positioning and perhaps considering other opportunities across the credit spectrum outside of traditional core fixed income.

1 “Recovery Rate” are usually measured in percentage of funds that are actually recovered when a default takes place.

2 Securities Industry and Financial Markets Association, as of March 2023.