The investor rotation out of U.S. stocks and into international stocks has been a big story in 2025, regularly capturing headlines. Some have pointed to an increasingly attractive market environment in regions such as the European Union, which has chosen a path of fiscal stimulus, greater defense spending, and loosening of debt restrictions. Others believe this rotation is occurring because of a ‘buyer’s strike’, whereby international institutions are dumping U.S. assets in protest of Trump administration trade policies and placing those funds into local asset markets.

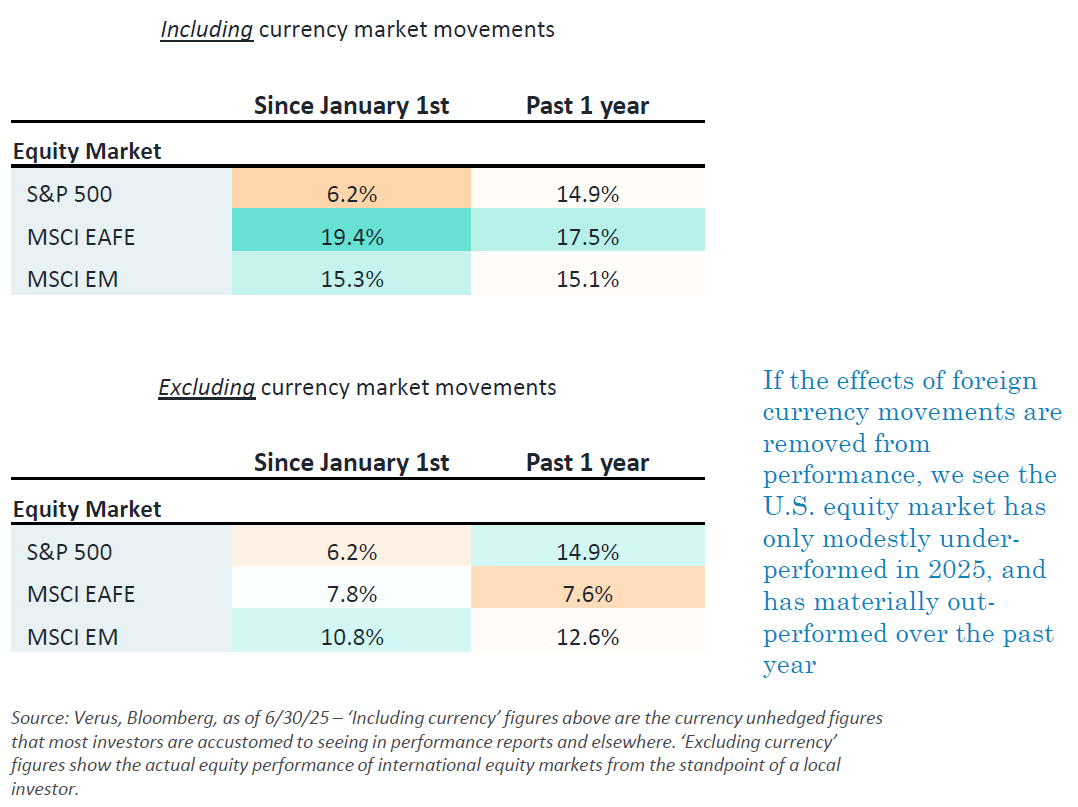

In this week’s Market Note, we illustrate that much of this story seems to be a mirage. It is foreign currency fluctuations that have contributed nearly all of the outperformance of non-U.S. equities relative to the U.S. market, rather than underlying equity market performance1. If these currency movements are removed, it is apparent that U.S. equities only slightly lagged in 2025 and outperformed materially over the past year.

- Most U.S. investors choose not to hedge the foreign currency risk of their international investments that are denominated in foreign currencies. This means that as those foreign currencies move down or up in value, the U.S. investor experiences a commensurate loss or gain in the performance of their international investments. In recent years, these foreign currency losses or gains have often been larger than the underlying performance of their investments. ↩︎

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.