Escalating tensions between Iran and Israel have led to fears of broader military conflict and a possible energy supply shock. Iran produces nearly 5% of the world’s oil, and approximately 20% of global oil and gas is shipped through the Strait of Hormuz, which could be quickly blocked by Iran.

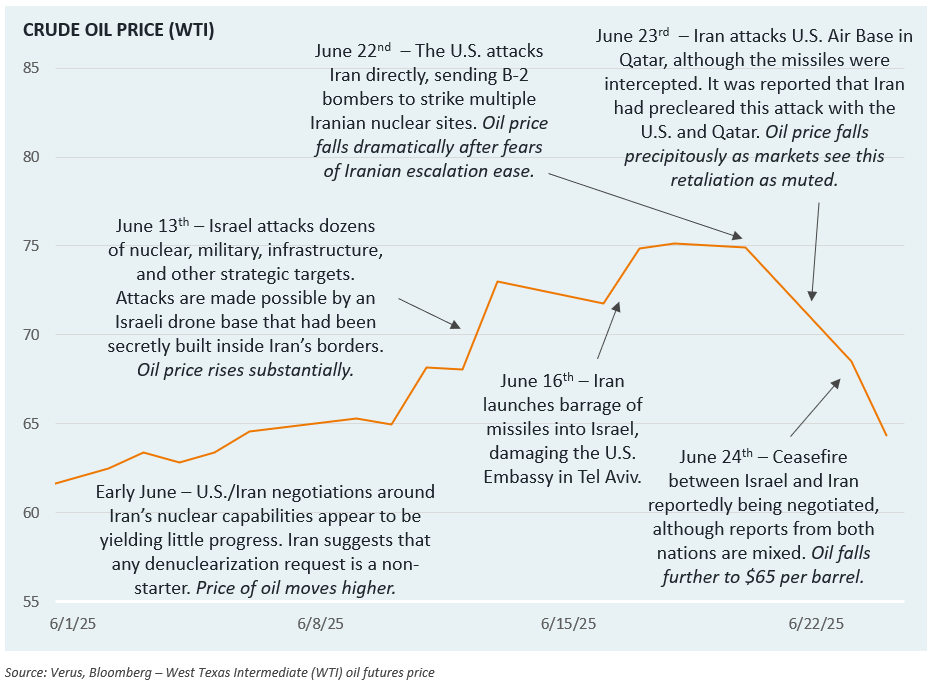

In this week’s Market Note, we chart the price of a barrel of oil alongside notable news and events in the region. There has been growing optimism for a ceasefire between the two nations after the United States executed a direct attack on Iranian nuclear facilities which was followed by a muted response from Iran. A ceasefire looks like it could hold, which has sent oil prices tumbling. Uncertainty remains high, however. With energy as an important element of inflation baskets, this may have implications for inflation and interest rates in the medium term.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.